The technical view for the EURUSD, USDJPY and GBPUSD through the FOMC decision....

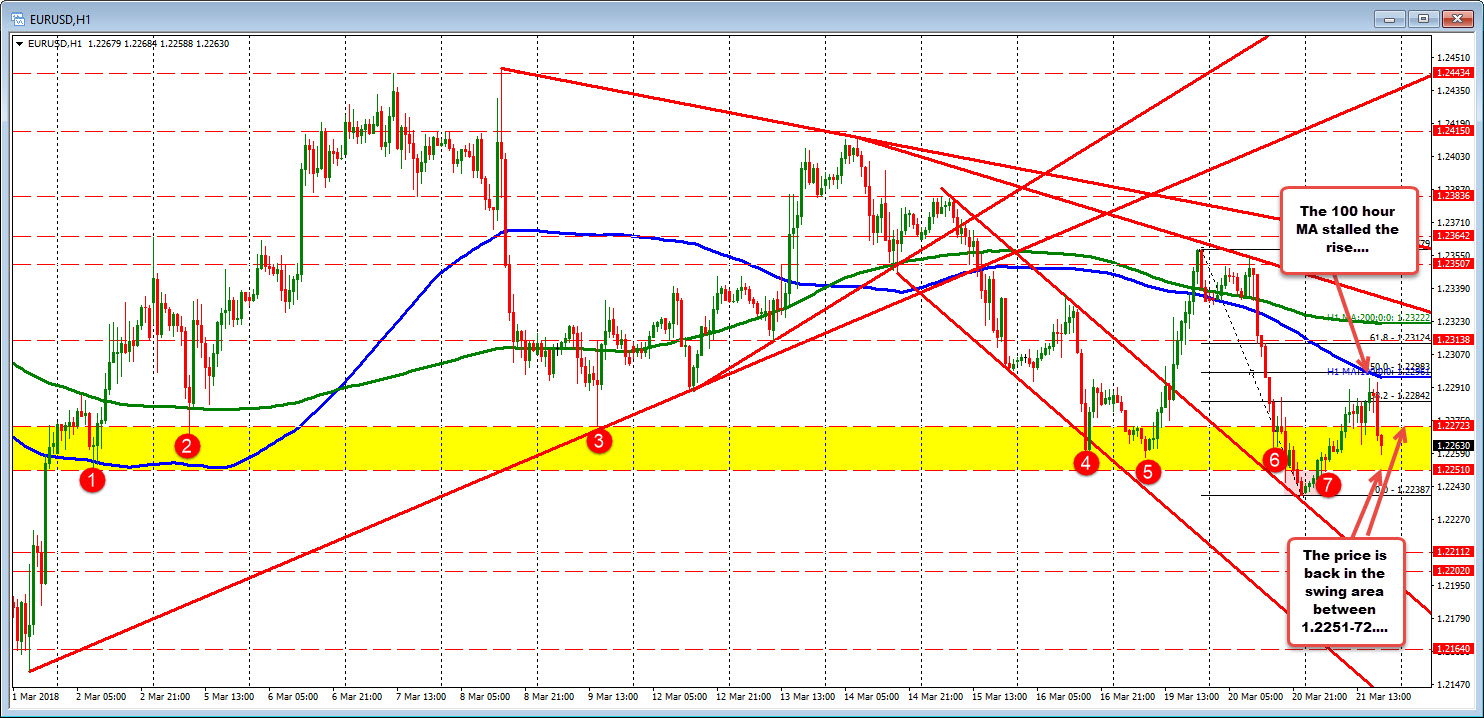

The EURUSD held the 100 hour MA at the highs today (blue line in the chart below). The price has rotated back down into the swing area defined by swing lows going back to March 2nd between 1.2251-72.

What the price action today does, is enhance the 100 hour MA as key level through the FOMC decision. A move above would be more bullish. The 200 hour MA will confirm the move.

On the downside, getting below the 1.2251 (and staying below thorough the report) will be more bearish.

The USDJPY has moved above the 200 hour MA (more bullish) at 106.329. The 100 hour MA (blue line) at 106.14, is key support. The price moved below the 100 hour MA earlier in the day, but then stalled at the level later in the NY session. At the 200 hour MA , the price did stall near the level before breaking higher in the current hourly bar.

Getting above the 106.44 (50% midpiont) will be a more bullish signal followed by a break of the topside trend line at 106.55.

For the GBPUSD, the price stalled ahead of the March high at 1.40879 and is also back below 1.4065-67 swing highs (see red circles 1 and 2). If going higher through FOMC, getting above those highs is the technical clues.

On the downside, the 1.4041 is a corrective low today (also near 50% of the days run higher). Below that the trend line at 1.4019 level. The key area for bulls and bears is the 1.3988 area. The 100 hour MA, 50% retracement and lowest swing high level from last week all come in at that area. Moving below it should change the bias for the pair more to the bearish side.