Trading range is getting more confined

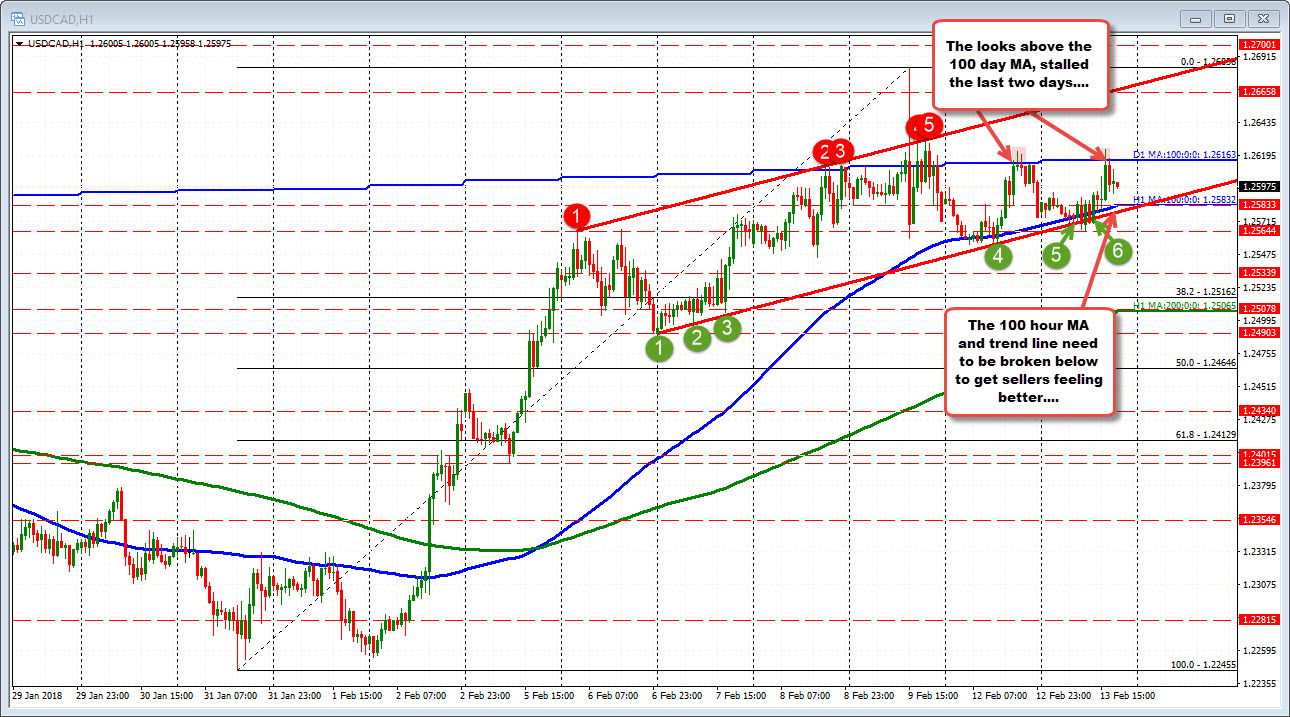

The USDCAD toyed with the idea of breaking the 100 day MA for the 2nd day in a row and turned away.

Earlier in the day, at the lows the pair toyed with the idea of going below the 100 hour MA and a lower channel trend line (in the London morning session). There was a number of hourly bars that went below the technical levels, but with little follow through momentum.

The range today, with the NA session extension, has taken it to about 58 pips. That is better than the 32 pips from before the NY opening, but it is still below the average over the last month of trading (about 94 pips). The 100 day MA needs to be broken (and stay broken) for this pair to head higher.

Conversely, without a break of the 100 hour MA and lower trend line, the sellers are not exactly winning either.

So the battle continues but the lines in the sand for the buyers and the sellers are getting more and more confined.

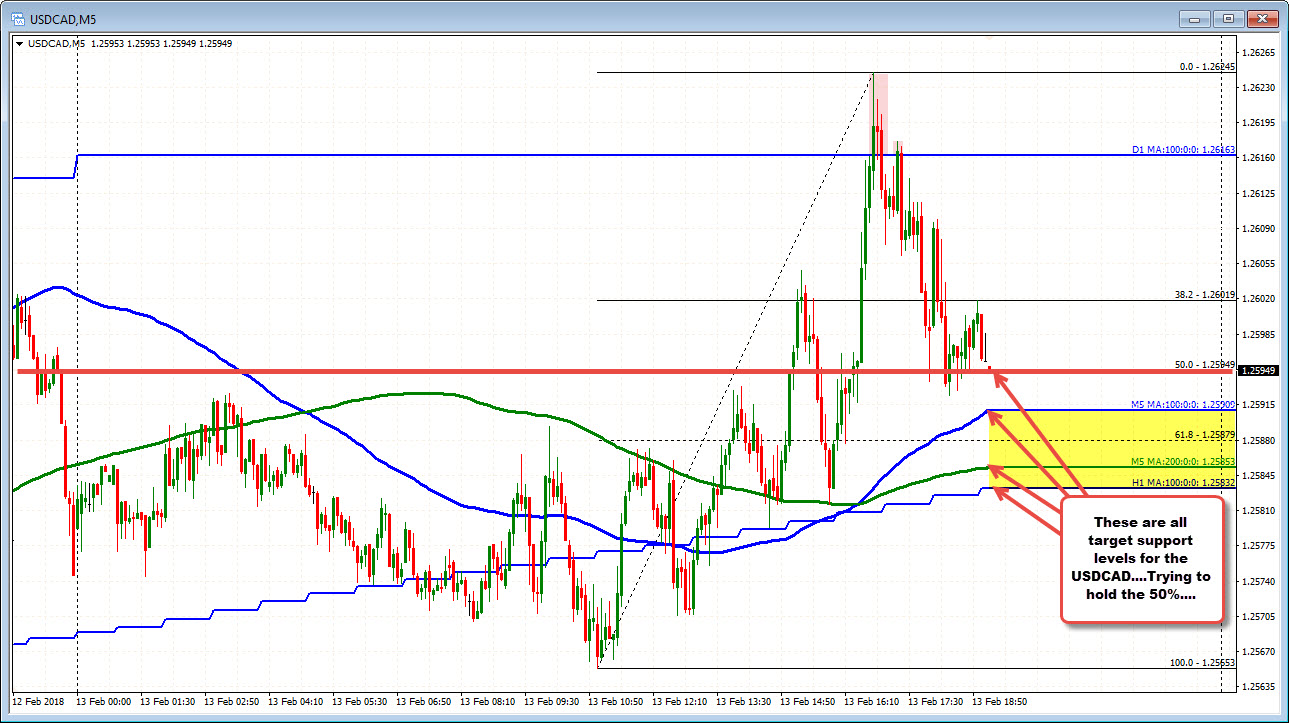

Drilling to the 5-minute chart, there is a lot of ups and downs today. The price is testing the 50% of the day's trading range. A move below that will start to pick at the other support targets including the 100 and 200 bar MA and the 100 hour MA. Each step below, takes another shot at longs hoping for a continuation higher. The 100 hour MAs more important along with the trend line on the hourly.

------------------------------------------------------------------------------------

Savage crash - RIP Cryptocurrencies? Five insights from the ASAC Fund.