Hike but with concerns about NAFTA

The BOC hiked by the expected 25 basis points but has concerns about NAFTA.

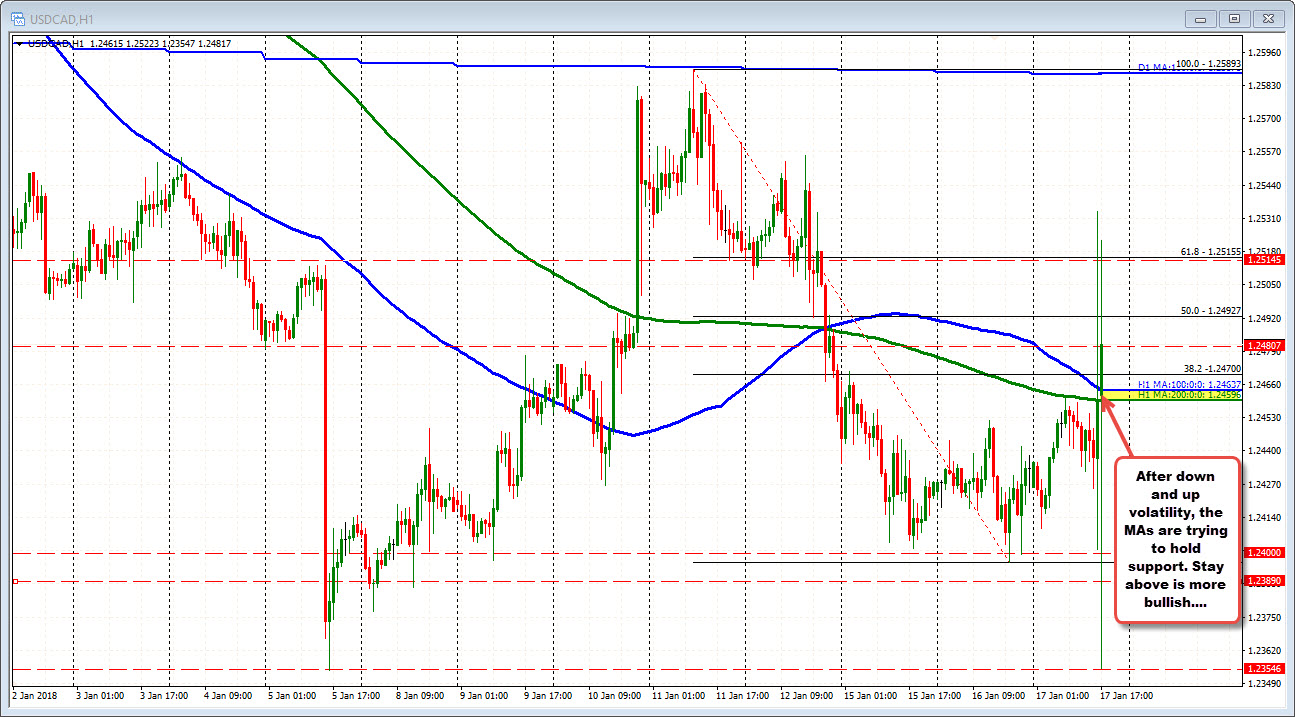

The price action took the price lower initially, with by price low coming in at the Jan 5 low at 1.2354.

However, the price then shot up on the back of the headline details The high price reached 1.2522.

The price has since moved back down to the test the 100 and 200 hour MAs at 1.24596-64. So far, those MAs are holding the fall. Stay above keeps the buyers more in control, while a move below muddies the water.

The presser is not until 11:15 AM ET/1615 GMT. So there is chance for more jockeying for posiiton. Right now, the buyers have a little advantage but risk remains elevated. However stay above the MAs and all is ok.

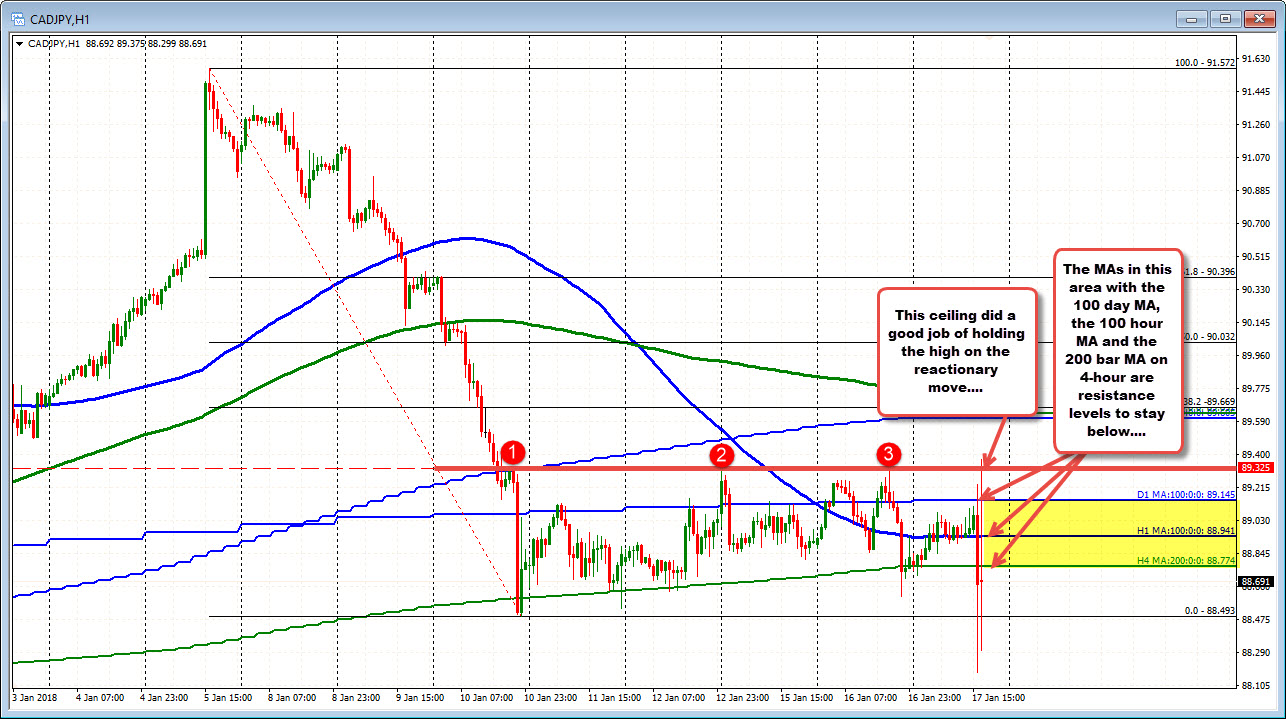

PS For the CADJPY, there has been ups and downs too. We currently trade below a collection of MAs with the 100 day MA at 89.14, the 100 hour moving average at 88.94, and the 200 bar MA on the 4-hour at 88.774. If the sellers are to keep control, that area would need to stall (with the 100 hour MA looking like it might be the bullish above and bearish below barometer).