USD/JPY trades at its highest level since 8 October

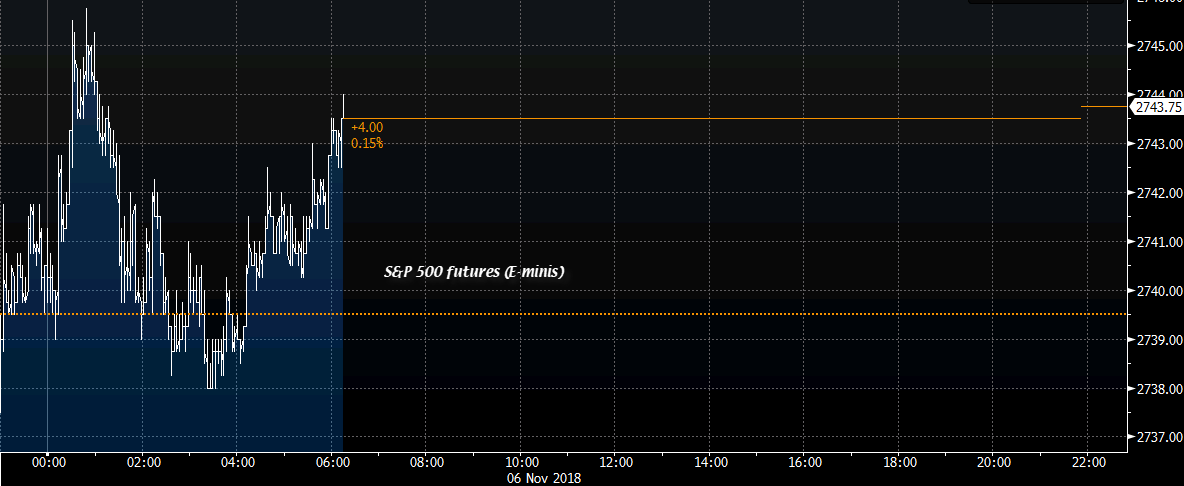

The pair touches a high of 113.43 on the session and that's the highest level it has traded in a month now. Yen pairs are moving up a little on the day now as E-minis are starting to inch up and is up by 0.2% currently.

The thing to note here is that trading volumes remain thin and even yesterday's trading in US equities saw less trades compared to the average for the year as the US midterm elections loom. I wouldn't read too much into the move higher here in yen pairs for the time being as a lot can still change over the next 48 hours.

The focus on yen pairs in the coming days will be on risk sentiment and how markets digest the results of the US midterm elections.

Truth be told, the midterms are a bit overhyped by markets and it's not really going to change much of anything regardless of the results. But the immediate reaction to the aftermath is what will be keeping markets preoccupied and that's what traders/investors are worried about.

The expectation here is for the Democrats to take over the House while Republicans hold the Senate. I believe this outcome is very much priced into equities now after what we saw in October and such a result will only see equities gain and risk improve. It means that we won't see any extreme policies come to play but we'll see some gridlock in Congress as a result. But that's something we've been accustomed to by now more or less.

The only way I see this ending badly for equities and risk is that Democrats take over both the House and Senate. It would result in uncertainty ahead of the 2020 elections and also mean further gridlock in Congress and slower regulatory changes. Not forgetting the possibility of impeachment could also be on the cards. But even so, the initial hit by stocks would be reacting largely to the surprise and the negative sentiment may linger for a bit. However, given time I still expect stocks to recover as we move into the new year - as they always tend to after election risks are cleared.

As for USD/JPY, the upside continues to look attractive in such a case. Should the expected outcome preside over the rest, we could be looking towards a retest of the key resistance level near 114.50 again in the coming weeks.