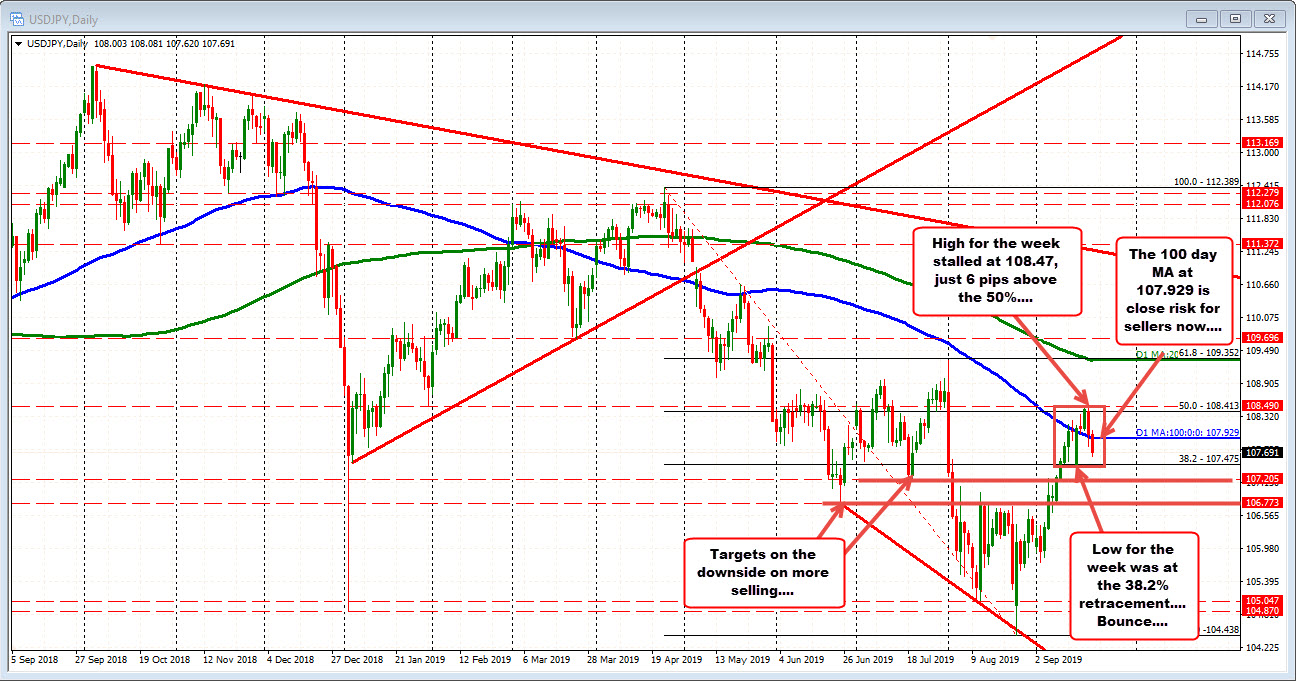

High was near 50% midpoint...

The USDJPY moved lower on Monday after the bombing of the Saudi oil facilities. That run ower took the price down to the broken 38.2% of the move down from the April 2019 high to the August low at 107.475. The price bottomed and ended up closing higher on the day.

On Tuesday and most of Wednesday, the price chopped up and down in a narrow range. At the end of day on Wednesday, the USDJPY moved hiigher, helped by the "less dovish" Fed (no more rate cuts in 2019

The high price on Wednesday and again in the early trading hours of Thursday stalled at 108.47. That was just 6 pips above the 50% midpoint of the move down from that April 2019 high.

So if you were to quantify the dynamics of the price action range, it bounced off the 38.2% retracement and stalled at the 50% retracement on the topside. Let's hear it for Fbonacci retracements.

What now?

Well in betweent the retracemetn levels sits the 100 day MA, and the end of week headline that China officials "took their ball and went back home" before meeting US farmers has hurt stocks, lowered yields and forced the USDJPY back below the 100 day MA at 107.929. In fact, the pair is currently within 20 pips of the lower 38.2% retracement (trading at 107.67 now).

Bears are in control below the 50%, and increased that bias below the 100 day MA. Close risk is the 100 day MA at 107.929.

The targets on the downside are now at 107.205 and then 106.77. They represent the lows from July and June.