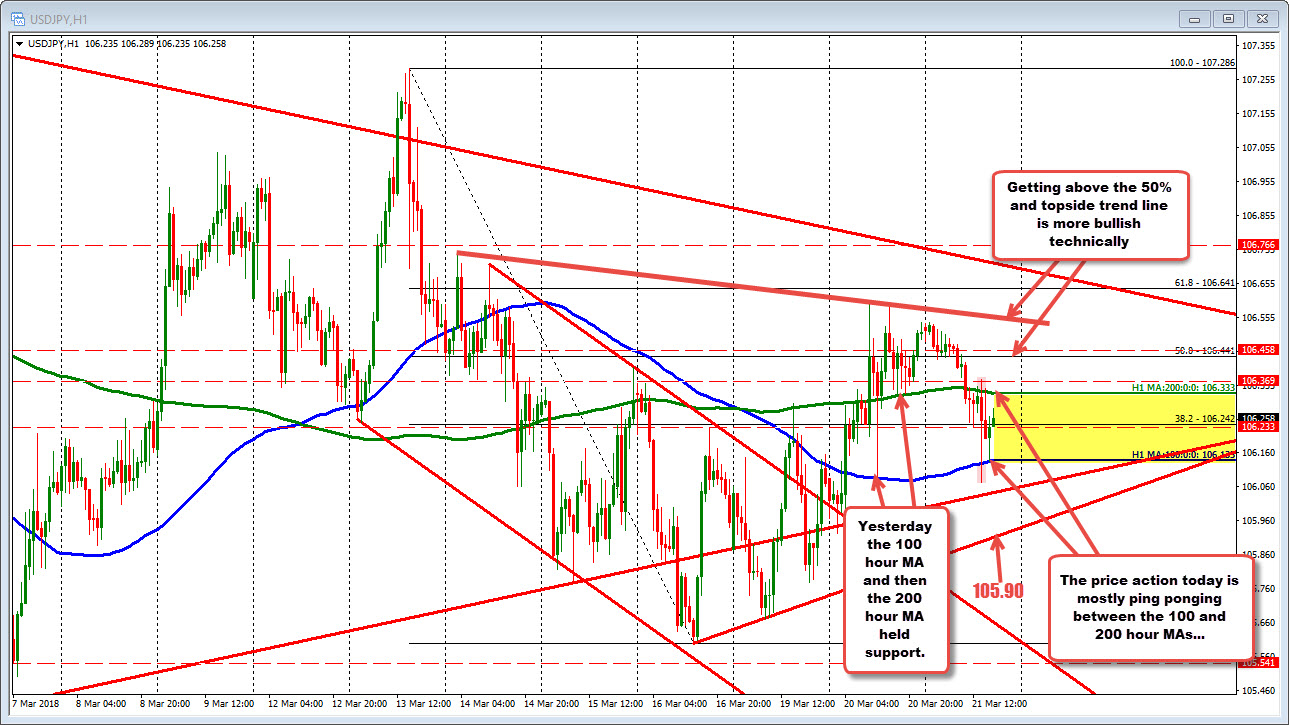

Support at the 100 hour MA. Resistance at the 200 hour MA.

The USDJPY is "ping ponging" between the 100 and 200 hour MAs for most of the day as the FOMC decision, statement, dot plot and presser is awaited.

Yesterday, the pair broke above both the 100 and 200 hour MAs (see blue and green lines in the chart above), and stalled the corrective falls in the NY session against the higher 200 hour MA (green line).

Today, that support level was broken and the hourly bars have stayed below that MA line. On the downside, the 100 hour MA (blue line) was broken on the tumble lower, but that break failed. The last test (the last hourly bar) stalled the fall.

So we ping-pong, and we can expect ups and downs into the FOMC.

You can try to trade the range, but understand that as the time ticks toward the FOMC decision, the event risk will be sky high. The market will also be dominated by position flows that could cause some volatility.

After the headlines from the decision (and dot plot), the market will react to all that stuff. Powell's first presser also add a new level of risk for traders that continues. Who knows what he says or if he says something a little more hawkish or dovish. He is still new to this.

All that adds to the risk for you/us as traders.

As a result, it is important to weigh your own risk tolerance (do you want to deal with it?), and understand that the market can be quite volatile.

Technicals help to lesson that risk by defining levels and the trading bias (bullish or bearish).

The 100 and 200 hour MAs, trend lines and retracement levels will help in doing that (see hourly chart). So plan the trade if you must/want to trade. If risk is too high for you, sit out until the risk is more consistent to your tolerance.