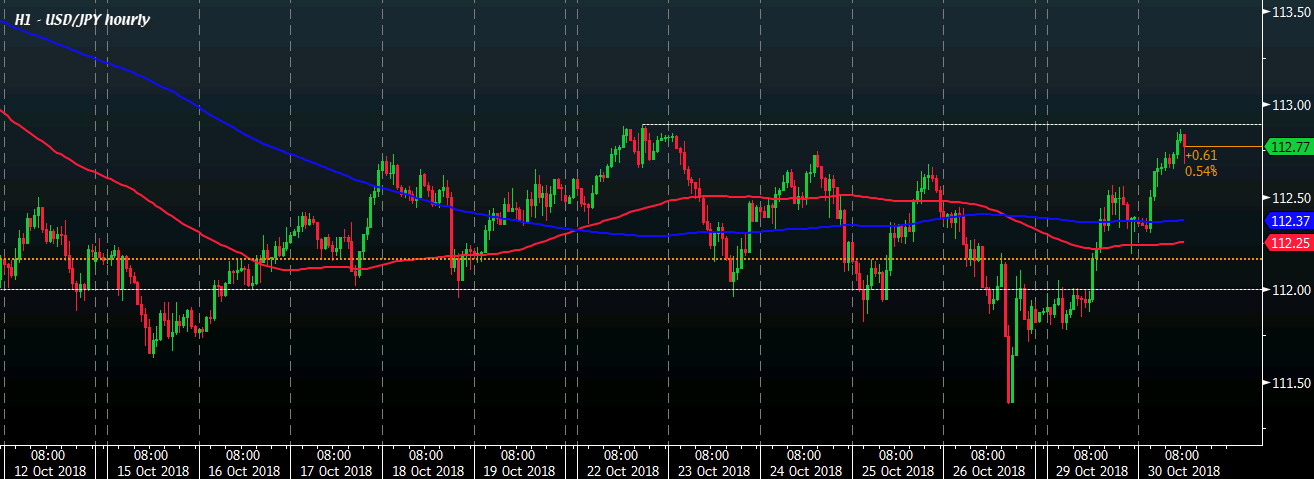

USD/JPY holds steady at 112.77 near the highs still

Much like how yen pairs failed to respond to the move lower in Wall Street overnight, we're seeing more of the same here. There was a brief dip in USD/JPY to 112.68 but that meant little compared to the drop in equities sentiment over the last hour.

European stocks started to lead declines and Italy's flat growth was the cherry on top to send equities in the region into the red today. And with that, E-minis are also virtually flat on the day now:

For USD/JPY, the pair still holds near the highs and continues to threaten a test of the 22 October high @ 112.89. As mentioned before, I'm still iffy about any recovery in risk until US traders give the green light but the breakdown in correlation here is really a puzzling one - even if it is not during US trading.

Is the market keeping an eye on the BOJ meeting tomorrow (which tends to be a snooze-fest generally)? Or are larger forces at play here? What do you think?