Barclays Commodities with a look at oil and some forecast revisions

Its a detailed research note, but in brief:

Although our price outlook remained bearish at the $85/b level at which the quarter began, we believe prices have overshot.

- Yet, only bullish weekly EIA data or production disruptions can stem the price decline before the OPEC meeting on 6 December in Vienna.

- Thus, further weakness is likely in store, which is likely to compel an OPEC+ reaction to keep some form of its cuts in place.

Given this short-term view, for prices to average $77 as previously forecast, oil would have to rapidly trade above $80 in December, which we now think is unlikely.

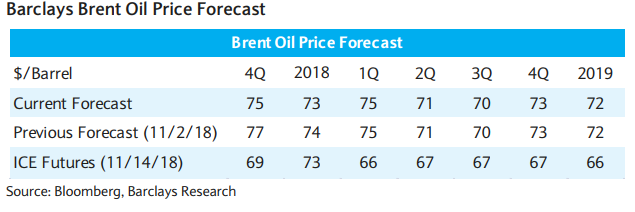

- We mark our 4Q Brent price forecast to $75/b, a slight $2/b revision from our prior forecast.

- We keep our 2019 forecast unchanged at $72/b and continue to see risks skewed to the upside next year.