Tim Duy on the Fed

The Fed might be swinging towards a more-dovish policy than markets anticipate. Not so much in terms of cutting rates but in terms of allowing inflation to run on the hot side.

In recent comments, Fed members have been increasingly sympathetic to criticisms that they haven't been able to hit their target. Or that they're acting as if 2% is a ceiling, not a symmetrical target.

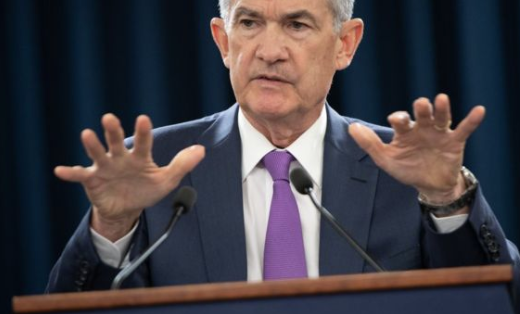

As Jerome Powell said, they have not "convincingly achieved our 2 percent mandate in a symmetrical way."

Fed watcher Tim Duy thinks that may increasingly be the Fed's strategy in a report here:

"Arguably it would be foolish if not downright irresponsible to enter the next recession without at least convincingly anchoring inflation expectations at 2%; an effort to do so might entail not just accepting above 2% inflation ahead of the next recession, but actually targeting a higher level to ensure that average inflation prior to the next recession is 2%."

The question is, can the Fed stick to that strategy? He wonders if the Fed will get cold feet when it becomes time to let inflation run a bit hot.

He notes that the Fed has been trying to push inflation higher but every time it starts to rise, it hikes and snuffs it out/

"Looking back over the last decade, I think it is safe to say that the Fed's errors have all been on the hawkish side of the coin," he writes.

He doesn't think it's deliberate but is a result of poor forecasting and misunderstanding the output gap and subliminal leanings towards wanting to declare mission accomplished when inflation hits 2% for a short time. At the same time, credibility is eroding.

For traders, the risk is believing that the Fed is capable of changing and capable of letting inflation run a bit hot. In the end, policymakers will fold once the pressure rises.

"The Fed is raising expectations of a policy shift; it is reasonable to conclude that the shift will be dovish in nature. The persistent undershooting of the inflation target since the Great Recession and the need to prepare policy to respond to the next recession lead to no other conclusion. This leaves me concerned though that the Fed is setting a dove trap by luring market participants to think future policy will be more dovish than policy makers are willing to accept in the future. "