Major indices in the red at the close

The major European indices are closing the day. The provisional closes are showing:

- German DAX, -0.32%

- France's CAC, -0.29%

- UK's FTSE 100, -0.45%

- Spain's ibex -0.8%

- Italy's FTSE MIB -0.2%

Looking at the daily chart of the German Dax, the index has been developing a lid against its 150 day moving averages. The 100 day moving averages currently at 15596. The 50 day moving averages at 15573. Ultimately would take a move above both to increase the bullish bias. Absent that and the sellers hold at least some control.

In other markets as London/European traders look to exit:

- Spot gold is trading down $1.13 -0.06% $1780.55.

- Silver is trading down $0.16 -0.65% at $24.11.

- WTI crude oil futures are trading down $2.41 or -2.9% at $80.98

- Bitcoin it is down $2900 or -4.39% at $63.92

In the US stock market, the NASDAQ is higher while the S&P and Dow are lower. The S&P is working on a six day winning streak. The NASDAQ is up five the last six trading days.

- Dow industrial average -127 points or -0.36% at 35482.37

- S&P index -5.22 points or -0.12% at 4531.07

- NASDAQ index up 27.14 points or 0.18% at 15148.92

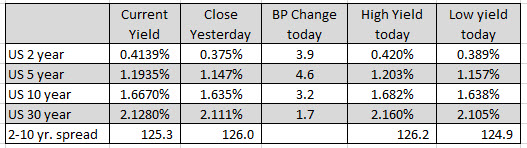

In the US debt market, yields are higher with the 10 year up 3.2 basis points. The five year is up the most at 4.6 basis points.

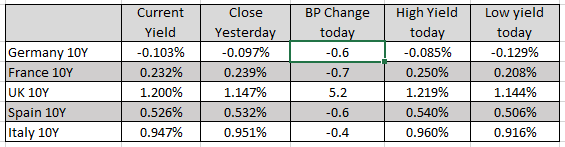

In the European debt market, the benchmark yields are mostly lower with the exception of the UK 10 year.

Finally a snapshot of the forex market is showing the JPY as the strongest of the majors as corrective price action dominates today. The NZD and AUD are the weakest. The USD is mixed/higher with the client against the JPY and the CHF offset by gains against the other major currencies.