A reminder

US 2-year note yields are down 3.7 bps to 0.427% today in a retracement after the march higher from 0.2% at this time last month.

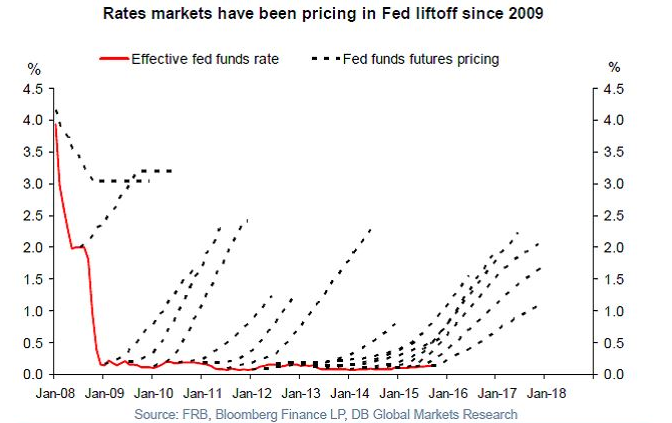

We're in the post-pandemic era but that doesn't mean it's time to forget all the lessons of the post-financial crisis era. One of the big ones was that the market consistently overestimated Fed hiking.

Here's a chart that clearly shows mistakes in futures pricing:

That's worth keeping in mind as the market begins to price aggressive rate hikes.

Maybe this time is different but the most recent Fed projections showed a slightly better than 50/50 chance of a hike next year while the market is pricing in two hikes.

For now the trade is likely to pricing more hikes but at some point it will run too far. I spoke with Reuters about the Bank of Canada and pricing for four hikes next year and four the year after.

"Central banks are being bullied by the market at the moment," said Adam Button, chief currency analyst at ForexLive. "At some point the Bank of Canada has to acknowledge a shift in market expectations or push back more strongly."

The Bank of Canada decision is on Wednesday and that will set the tone for the Fed and others.