Even I’m struggling to hang on to my reasons for maintaining a long euro position at the moment.

The data hasn’t really improved and the only chink of light is the new business numbers from the services and composite PMI’s that were just out. But even that sector only accounts for a small part of the european economy.

Inflation is still dangerously low but it’s stopped dropping, for now.

The other saving grace is the fact that the euro is notoriously hard to knock down.

In theory this meeting could be a dead duck. They’ve cut rates, announced the TLTRO’s and so the can is kicked. They’ll need a few months to see the effects of the new rate cuts and the economic injections are months away.

That may not stop him from from dumping a few dovish comments on us though. The risks are still apparent and the currency is one of them.

If he wants to dump the euro some more then I expect him to ramp up the chatter on QE. Talking about it and doing it are worlds apart but as with the OMT, he’s not afraid to hit us with tools that may never see the light of day just to get a reaction in the market.

The rate cuts also amounted to tinkering around the edges rather than a thunder and lightening move but that might also not stop him from mentioning further cuts in the next few months.

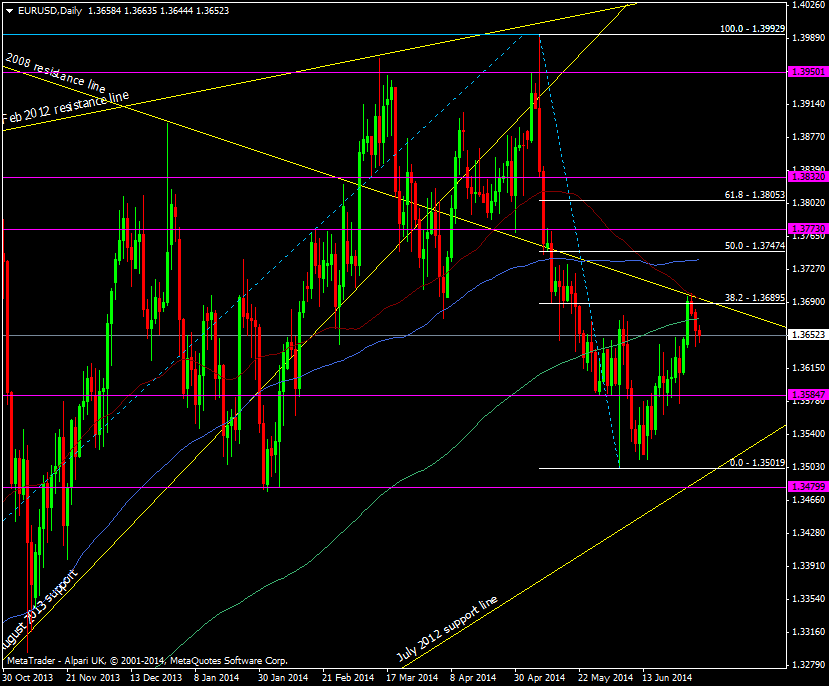

As for trading, 1.3585 is the closest big level to watch below then 1.3500, 1.3480/89

EUR/USD daily chart 03 07 2014

Above, 1.3700 is the nearest big line in the sand if he’s not as dovish as some expect. Higher still, the 100 dma and 50 fib of the 1.3993 fall at 1.3738/47 is another key area to watch as is 1.3770 which is a former S&R level.

As always we’ll have it covered at 12.45 gmt+1 and then the presser here 45 minutes later, right as the NFP comes out.

It’s a potentially dangerous cocktail for trading but there is a good chance of catching a fantastic trading opportunity.

We’ll get the NFP number instantly while Draghi is still smiling for the snapshots. An ideal situation would be a really crappy NFP number, which rockets EUR/USD, which is then followed by a dovish Draghi. We’ll have to be quick if the stars align, and it’s going to be choppy so we’ll need our wits about us, but I like the chances of that trade if the parts plays out.

Let’s ‘ave it!