Banxico follows the Fed

- 1st increase since 2008

- rate increase is in response to Fed hike

- not raising rates could have left the MXN vulnerable

- says US industrial production remains week

- To pay particular attention to posture vs. US

- growth risks improved since last rate meeting

- Banxico to position itself to take more measures as needed.

- Says most emerging economies have been slowing down.

- Banxico to pay particular attention to a cut economic slack.

- Banxico to pay particular attention to MXN impact on CPI

- Renewed peso drop could spur on inflation

- Sees inflation ending in 2015 at 2%

- 3Q growth was better than expected

- exports have been stagnating due to US industrial production, oil

- balance of risks for CPI improved in short-term.

- Effect from week MXN orderly and gradual

- says 2016, 2017 market inflation expectations nearing 3%

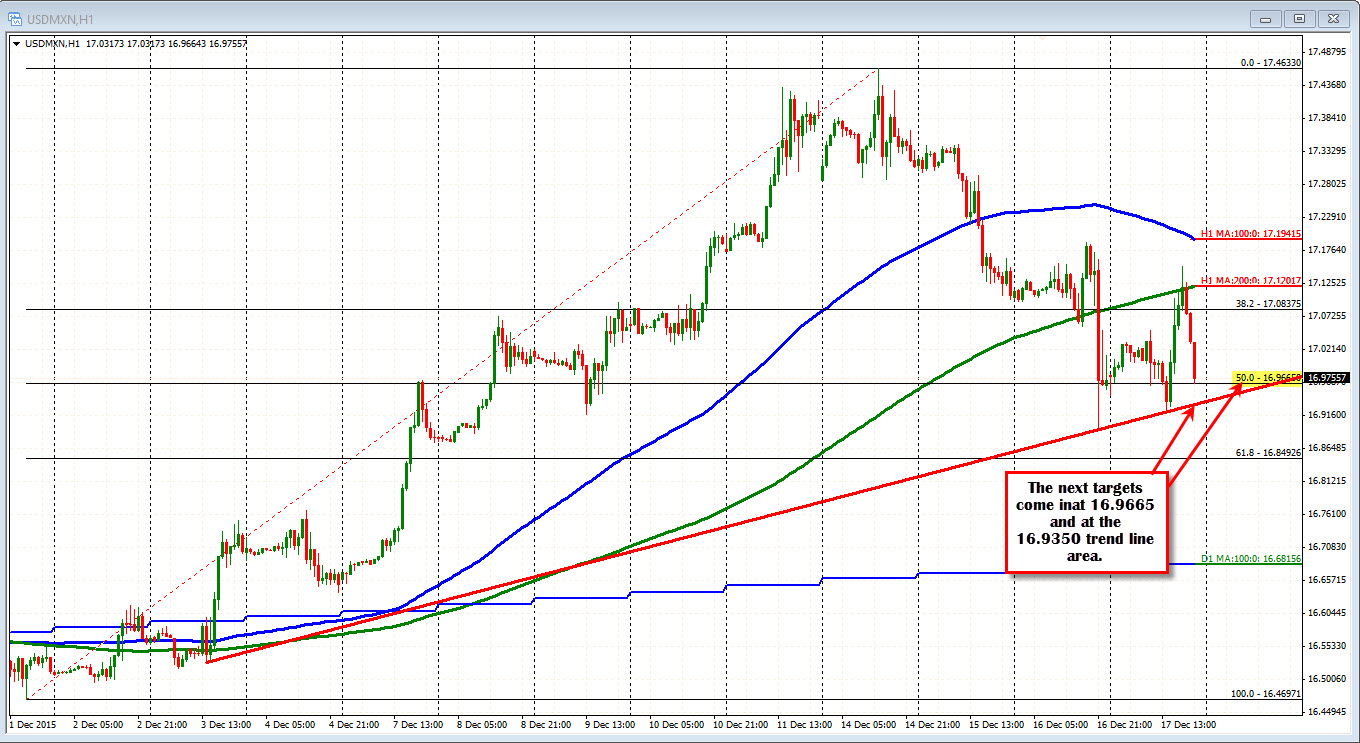

The mexican peso has strengthened since the announcement with the USDMXN. The high today breached the 200 hour MA (green line in the chart below) at the 17.1202 area. The high reached 17.1509. However, that move was short lived and the pair has been moving lower into the meeting. THe 50% of the move up from the December low comes in at 16.9665. Below that is a trend line connecting recent lows. That comes in at 16.9347. A move below those levels should solicit more selling.

Looking at the daily chart, the USDMXN has been consolidating over the last 4 months. Earlier in the week, the pair reached to new highs but failed. The 100 day MA atthe 16.6816 level is a key support as is the trend line connecting the lows going back to October 2014. That level comes in at 16.5643 currently.