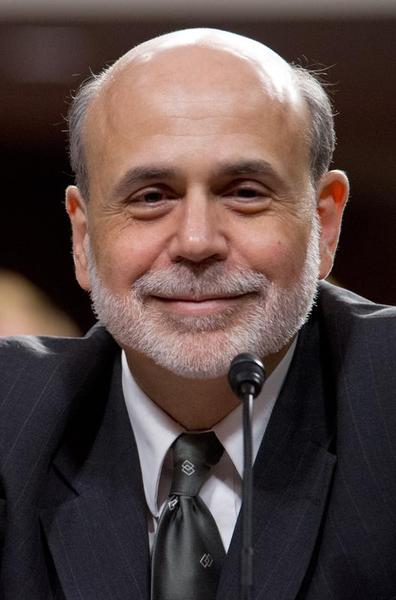

Market Watch have grabbed a few words with the man who handed the torch over to Janet Yellen

- Rate rise will be a landmark decision given that rates have been at zero since 2008, which was longer than anticipated

- Fed was over-optimistic about pace of growth in not anticipating the slowdown in productivity

- Cyclically the economy recovered faster than expected

- Domestic economy is now sufficient to overcome headwinds from the global economy

- Heavy selling in markets is not an impediment to hiking rates

He makes an interesting comment on what level of global concerns would halt the Fed hiking;

"Well, so, there are two issues. One is the effects of the global economy on the United States, which is the primary concern for the Fed, because the Fed's mandate is to achieve domestic objectives, namely maximum employment and price stability. And it is the judgment of the FOMC that the domestic strength of the U.S. economy will overcome those headwinds from the global economy. A related issue, however, is the risk that between Fed tightening, stronger dollar, weaker China, and various other international developments, that there will be financial stress in emerging markets. And that is certainly something that the Fed and other international agencies have paid close attention to. If that were to happen and it were severe it could feedback on the U.S. economy and would be a concern for the Fed, but the Fed's interest-rate decisions are, in the first instance at least, motivated primarily by the outlook for the U.S. economy."

The Bernanke article is a good read ahead of the FOMC. Obviously Yellen and Bernanke are two different people but they would be looking at the same things when deciding policy, and so it's a small snapshot into the mind of a Fed head

What would Uncle Ben do tomorrow?