The Bank of England today published, in a special release, the minutes of Court and related meetings from the crisis period of 2007-09, in appropriately redacted form. This follows the Bank’s 11 December 2014 announcement of a series of proposals to enhance the transparency and accountability of the Bank. As part of this announcement, the Governor committed to publishing the 2007-2009 Court minutes, as requested by the Treasury Committee

Interesting publication by the BOE today as the then Labour govt tried to rush through legislation that the BOE, under governor Mervyn King, thought was led

in the main by the need to demonstrate that the Government was acting to address the identified problem

King had to tell the then fin min Alistair Darling that

ensuring the legislation was right was far more important than meeting an arbitrary timetable

Bank officials also debated “at what point in the process” they would tell the government that they would not commit to

an ill-conceived and rushed legislation programme.

But there is also evidence of the BOE being unaware/underestimating the extent of the impending crisis

Current Treasury Select Committee chairman Andrew Tyrie has been highly critical of some of the Court’s non-executive directors.

He said they had failed to challenge senior executive members, like the then governor, Mervyn King, whom some accuse of failing to prioritise financial stability.

The minutes show that during the crisis the Bank of England did not have a board worthy of the name. This mattered. And it still matters

While the TSC chairman at the time Lord John McFall said this morning

They all missed the wider picture. They missed the interconnectedness of the whole financial system.

King and Brown and the blame game

Current gov Mark Carney says

The financial crisis was a turning point in the Bank’s history. The minutes provide further insight into the Bank’s actions during this exceptional period – the policies implemented to mitigate the crisis, the lessons that were learned, and how the Bank changed as a result.

The Bank is committed to increased openness and transparency and these minutes, in combination with the other recent reviews, provide a complete record of the Bank’s activities during the crisis

The documents also reveal that the Bank’s “Court” or oversight body met the day before Northern Rock collapsed in September 2007. However, they were not told about the impending crisis because several of the members had conflicts of interest.

They also reveal that the building society Alliance & Leicester had to be offered a £3billion lifeline by the Treasury in November 2007 before it was sold to Santander. The building society was referred to by the code word “Tiger” in confidential bank documents, which

“emphasised that there needed to be considerable secrecy about this facility.

Queues formed outside Northern Rock when plans for similar measures leaked and the rest, as they say, is history

Fascinating stuff and if you have a spare few days you can read it all here

or The Telegraph has more highlights here and the BBC here

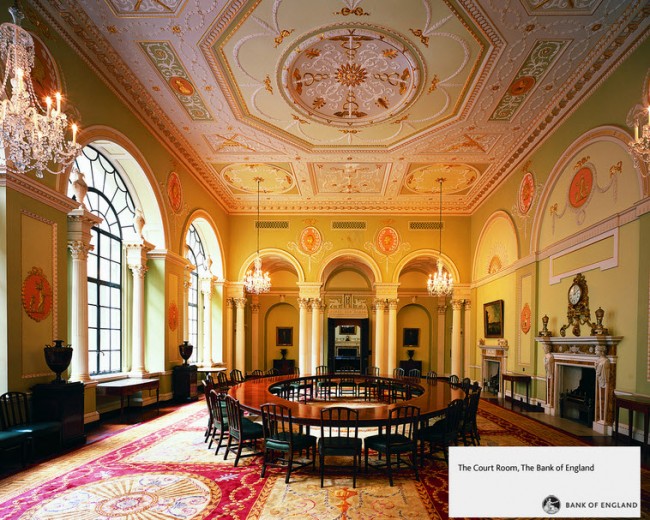

Bank of England’s “Court” Room – I bet that wasn’t decorated in a day