The single currency has taken another knock down to a low of 1.2758 following the ECB rumours but we still remain in a short term upward trend in October.

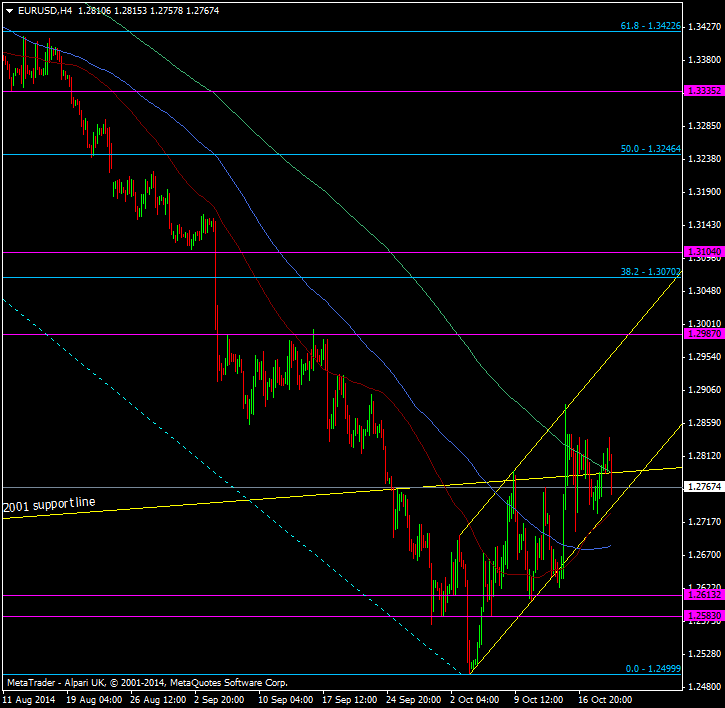

EUR/USD H4 chart 21 10 2014

The lower end of this short term channel is around 1.2743 and we have the 55 h4 ma just under there at 1.2732.

The market has taken the news as a prospect of the ECB ramping up support for the economy and stocks are up on their highs for the day. Corporate QE is music to stocks. It’s two fold for the currency as obviously it’s a further sign of ECB pumping but also a lot of that cash is going to be hit by negative interest deposit rates in Europe. That could mean that firms look to move the funds elsewhere and that will mean out of Europe, which is probably something they are doing anyway. Either way it’s negative for the euro.