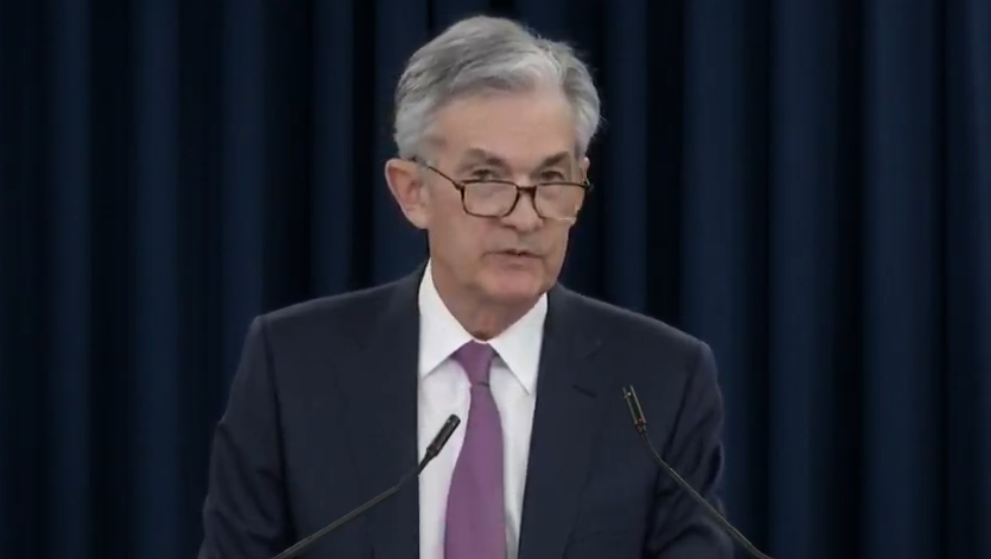

The Federal Open Market Committee announcement and Powell's presser were Wednesday US time.

- No signal of a policy shift from the Committee. No one expcted any, so no surprise here. in policy today.

- FOMC cut to interest on excess reserves IOER (by 0.05%) - this a technical adjustment to keep fed funds rate within the target range

- There was an acknowledgement of weaker inflation in the statement … Chair Powell followed up in news conference saying weak inflation pressures may be cause by transitory factors

Summing up … not as dovish as was expected. USD gained, stocks took a wee hit lower.

As it happened (read from the bottom up):

- Stocks end at lows after rally fizzles on Powell's less dovish comments

- At the start and at the end of the press conference from Fed's Powell

- Powell Q&A: We don't see a strong case for moving in either direction

- Fed's Powell: Incoming data have been broadly in-line with expectations

- The full FOMC statement for May 2019

- Federal Reserve holds interest rates in 2.25%-2.50% range, as expected