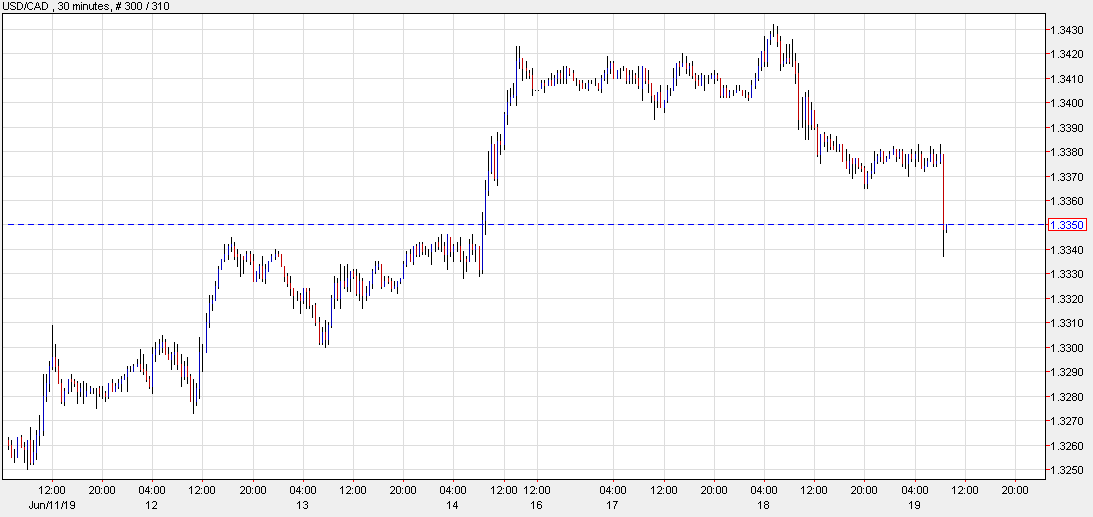

USD/CAD falls on CPI report

The Bank of Canada may find itself on the sidelines as other major central banks lower rates. Cuts from the Federal Reserve and ECB are looking increasingly likely while the BOC watches and waits.

"The Bank expects CPI inflation to remain around the 2 per cent target in the coming months," the BOC said in the most-recent statement.

The world 'around' is vague but inflation rose to a seven-month high at 2.4% in today's report, far above the 2.1% consensus. Excluding gasoline, it rose 2.7%.

The OIS market is pricing in a 38% chance of a BOC cut before year-end. That had risen as high as 53% earlier this month but it's faded on strong data.

The next meeting is July 10 and it increasingly looks like the line "the degree of accommodation being provided by the current policy interest rate remains appropriate," isn't going anywhere soon.

The surprise in the latest BOC statement was that growth forecasts were lifted. The statement said growth was in-line but economists now see this year at 1.5% compared to 1.2% at the BOC. Unemployment is at all-time llows and housing has stabilized and may now pickup thanks to falling rates.

One element that has been spotty is the consumer. Retail sales are due on Thursday and forecast to rise 0.4% excluding autos.

For now, the drop in USD/CAD has been limited to 30 pips because of uncertainty around the Fed. If the FOMC is dovish (but not too dovish) then there's a great case for buying the Canadian dollar (ie selling USD/CAD) on the way to 1.3225). Alternatively, buying CAD on the crosses (AUD/CAD) is a nice way to bet on central bank divergence while filtering out the Trump noise.