How large will the taper be?

The Bank of Canada is buying $3 billion in government bonds per week at the moment but with today's strong jobs report, they're highly likely to cut that further at Wednesday's meeting.

"The data likely seal the deal for a further tapering of asset purchases next week by the Bank of Canada," CIBC writes in a post-jobs report.

Reuters yesterday surveyed 21 Canadian economists and they unanimously predicted a taper but varied on whether it will be $1 billion, $2 billion or something in between.

The consensus remains for the first rate hike to take place in Q4 of 2022 but that could soon creep forward. Consensus GDP growth for this year is up to 6.2% from 5.8% in a June poll. For next year, the consensus remains at 4.0%.

The large majority if economists see a $1B taper but the BOC could move faster or signal an openness to taper at every meeting, which would quicken the expected pace.

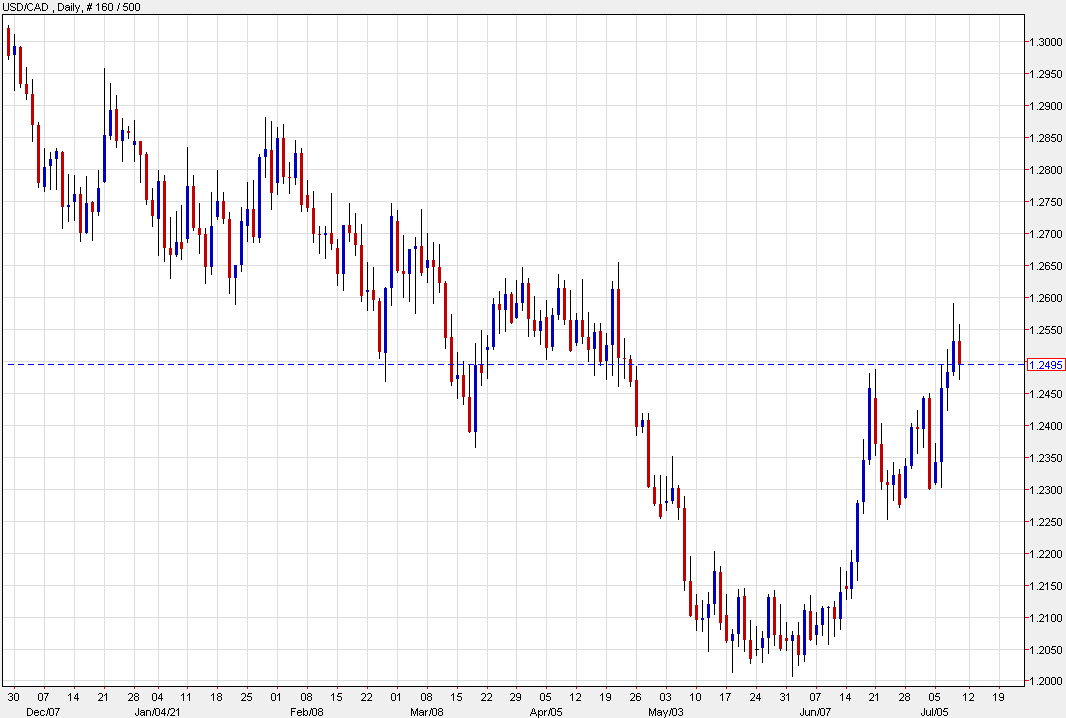

Another factor that could encourage the BOC to taper more is the recent weakening in CAD. With USD/CAD at 1.25, they face less immediate risks from the currency. If they were to go by more than $1B though, I would expect a sharp fall in the pair, especially with oil prices rapidly recovering from the early-week swoon.