Fed Chair Janet Yellen speaks in Providence, Rhode Island on Friday.

Providence -- which also means 'timely preparation for future eventualities' -- is a appropriate place for Yellen to speak next Friday (May 22).

The subject of the speech is the US economic outlook. There is a prepared text but no Q&A.

The question has to be: Will Yellen hint at lower economic growth.

So far this year, the Fed and economists have been stubbornly holding onto the idea that 3% growth is right around the corner. With a 1.1% pace of contraction in Q1 and a slow start to Q2, it's not going to happen.

Yellen isn't going to come out and say that the Fed isn't going to hike in June or September -- the Fed has fought far too hard to put the focus on data. But Yellen could (or should) acknowledge that economic data has been soft and that the economy is growing more slowly than anticipated.

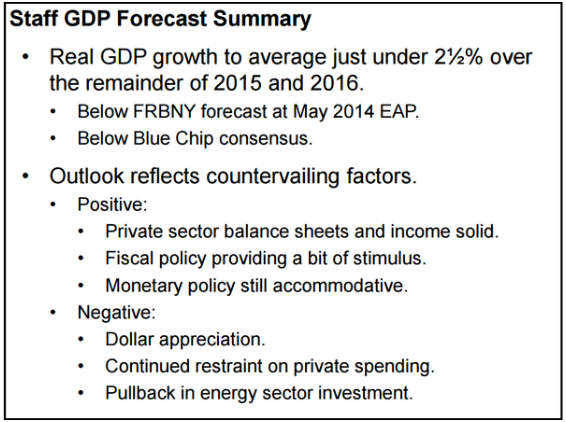

Just today the New York Fed lowered its staff forecasts for GDP this year and next.

Yellen acknowledging the data is simply stating the obvious but it will have major implications for markets and will spark a fresh wave of US dollar selling that could clear out crowded dollar-longs.

What's the trade?

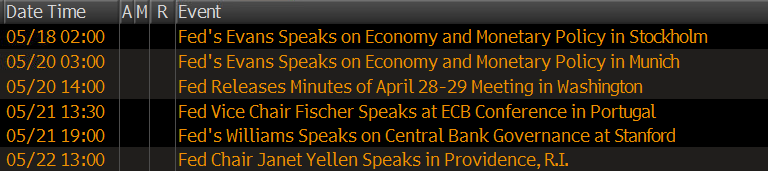

The FOMC minutes and Vice Chair Fischer are also on the docket next week.

On Wednesday, the FOMC minutes aren't likely to show the same level of concern and Fischer is more hawkish than Yellen so he probably won't be the one to break the taboo of speaking about a weak economy.

So that sets up some US dollar strength mid-way through the week followed by selling on Friday and into the following week on Yellen.