UBS continues to believe the Federal Reserve will hike in Sept

Domestic momentum seems strong enough to support the beginnings of policy normalization with a rate hike in September, UBS writes.

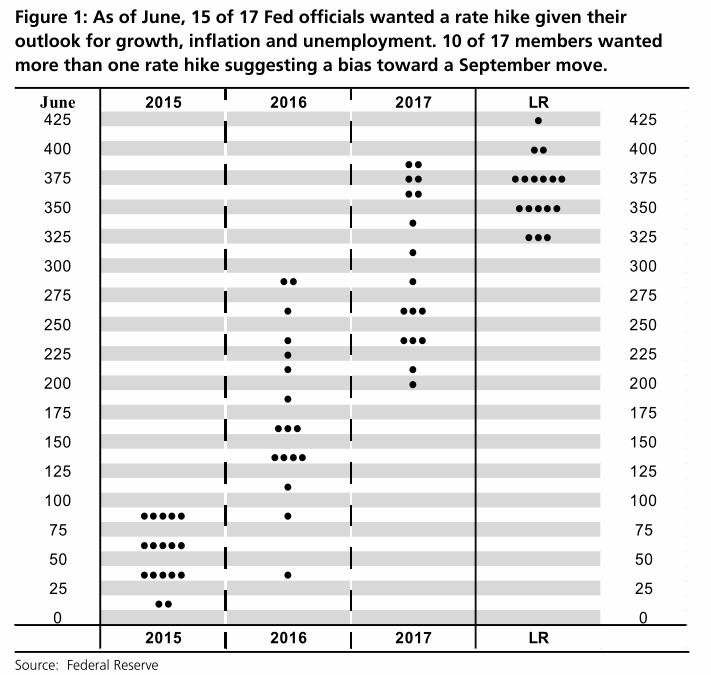

1) The main basis of their belief is the dot plot. That's the forecast from each Fed member about where rates will be at a given period. They note that in the June forecast only 2 of 17 FOMC members said they didn't anticipate a hike this year and that 10 see more than 1 hike.

2) They say September offers a compromise between hawks and doves, getting one rate hike "out of the way" without committing the Fed to more.

3) It provides optionality for those who anticipate that more than one hike this year would

likely be appropriate.

4) Another advantage is that it avoids any risks resulting from policy changes around year-end, when bank funding issues tend to become more complex.

The important consideration is how conditions have evolved since June. Naturally worries about emerging markets, inflation and volatility hurt the chances of a hike but they anticipate that cooler conditions will win the day. They say next week will be key.

"Foreign strains and their spillover into financial markets are likely to continue to weigh

on participants. However, financial conditions have become easier over the last few

days. What will matter to the Fed will be financial conditions the week of the meeting," economist Drew Matus writes in a note.

At the moment, Fed fund futures are pricing a 34% chance of a hike on Sept 17.