TD analysts are forecasting the Reserve Bank of Australia have reached the peak of the cash rate.

The analysts concede there is still the possibility of a November rate hike:

- Should the labour market remain firm and there is evidence that higher labour costs are being passed through

And add further cash rate upside risks come from higher property prices supporting consumption (through the wealth channel) and higher oil prices.

TD concludes with the implications of the terminal rate having been reached:

- Given our view the RBA cash rate peaks earlier and lower than our prior 4.85% forecast, the RBA is therefore expected to keep the cash rate on hold for longer.

- We now push out rate cuts from Q2 2024 to Q3 2024.

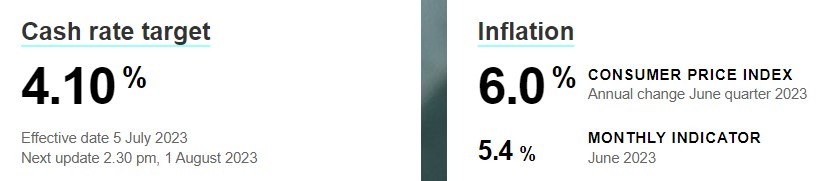

The Reserve Bank of Australia's cash rate is at 4.1. The next meeting is September 5.