It may be more complicated than you think. You need to know your risks

Adam posted that Barclay's sees USDMXN surging on a Trump victory.

That certainly (well... is very likely) would be the case. Of course today we are seeing those hopes being hurt after the weekend FBI news, and the resulting expectations that the mountain climb may have gotten too difficult for Trump. The votes still have to be counted and with Brexit in the rear view mirror, the road ahead may still have twists and turns. It ain't over until it is over.

Nevertheless, we have seen a breakaway to the downside on the increasing Clinton optimism.

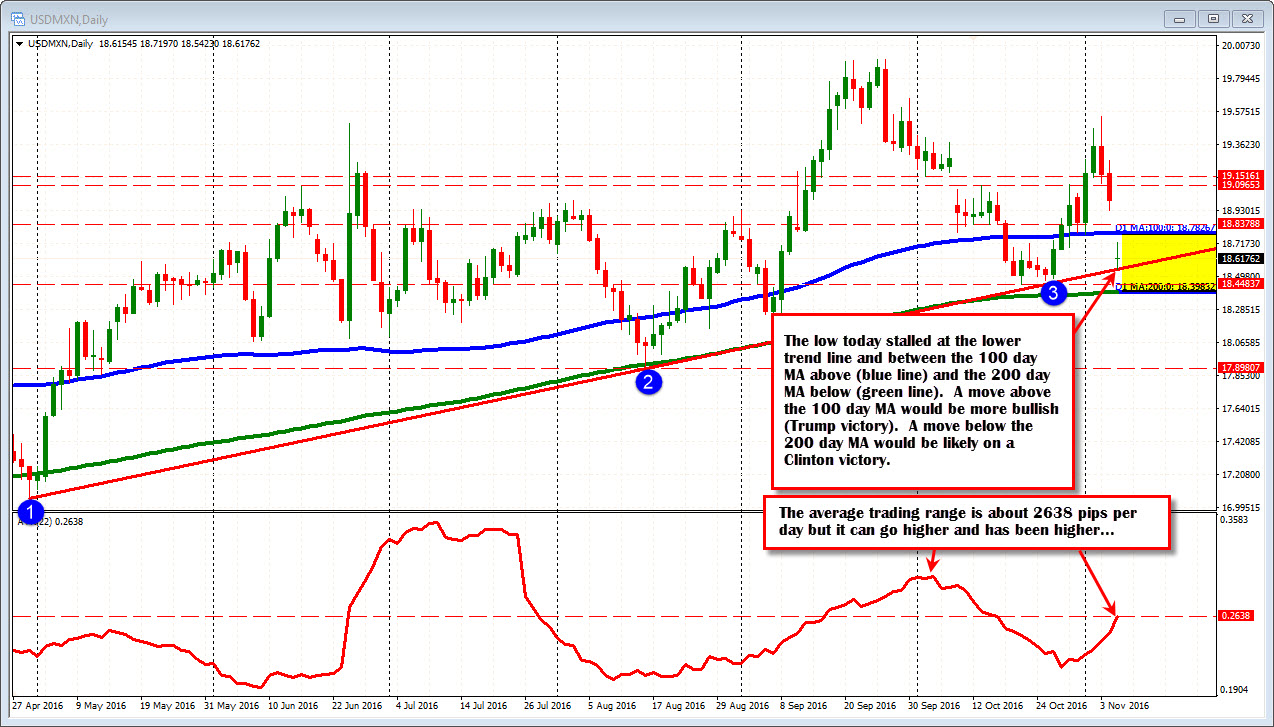

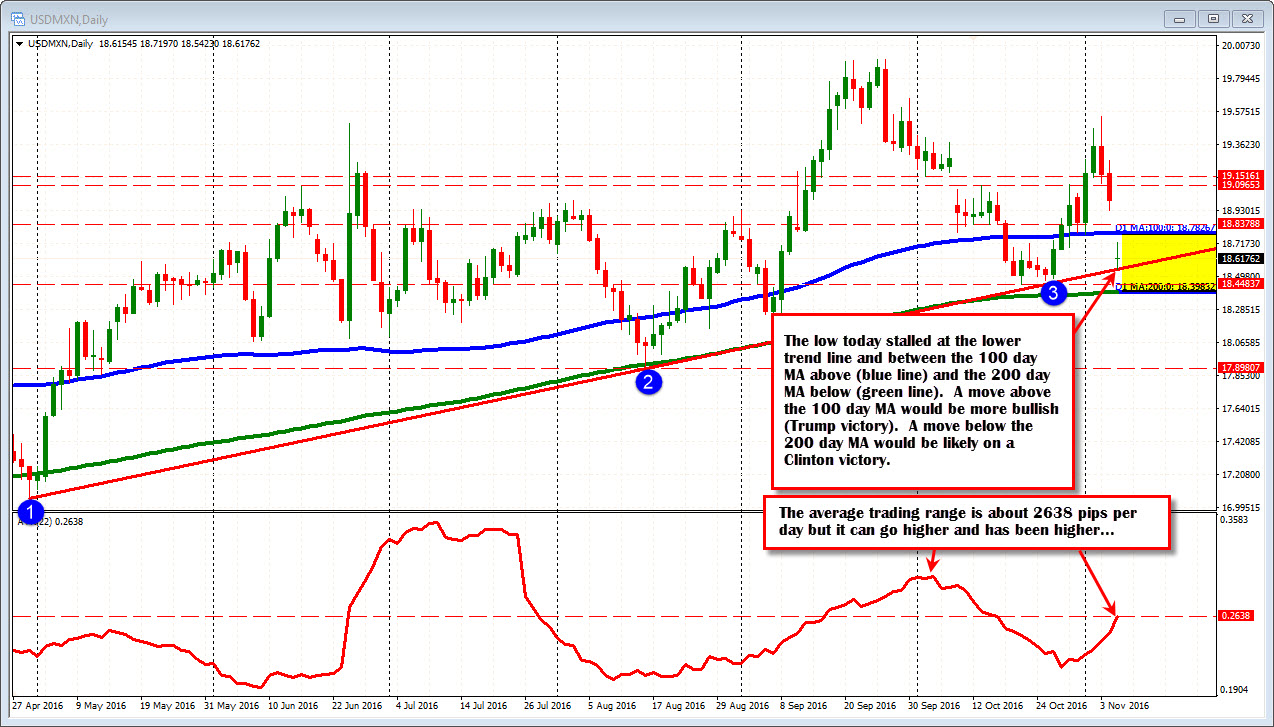

Looking at the daily chart above, the USDMXN has tumbled lower. The move today - including the range from the close to the low - is 4,533 pips. That is a lot of pips. The EURUSD range is 83 pips. The USDJPY range is 89 pips.

That move in the USDMXN has taken the price below the 100 day MA at 18.7825 (blue line in the chart above). Last week (on Monday and Tuesday), the price based against that MA level (follow blue line). So moving below is a change of bias from bullish to bearish.

Needless to say, if the bias is to turn back to bullish (on a Trump victory), a move back above that level would be a big clue. Honestly, it might only take exit polls that say Florida or NC or Ohio is looking good for Trump to get a move toward that level.

On the downside, we remain above the 200 day MA at 18.3982 (green line in the chart above). IF the price were to go below the 200 day MA line, that would increase the bearish bias. That may come on exit polls saying Florida is looking like it is moving toward Clinton (or NC or GA or Ohio).

The current price is at 18.6615 (as I write). The price is in between the 100 day MA above, and the 200 day MA bellow. The low today, found support right at the trend line connecting lows from April and August. Technical tools even work for USDMXN in what has been a very volatile day. That trend line will be eyed by traders going forward.

SO how far is the current price from the 100 day MA above and the 200 day MA below?

The distance - in pips - from current price to the 100 day MA is:

100 day MA level - Current price = Pips to more of a bullish bias

18.7826 - 18.6615 = 1,211 pips

How far away is the current price away from the 200 day MA below?

Distance from the 200 day MA currently:

Current price - 200 day MA level = Pips to a more bearish bias

18.6615 - 18.3982 = 2,633 pips.

That seems like a long way from each? Is it?

Before we answer that, if you are to trade the USDMXN, it is important to understand the price dynamics and risks for that pair. You should know, things like:

- What is the value of a pip?

- What is the average trading range?

- What is the Bid/ask spread.

What is the value of a pip on a 10,000 mini lot position in the USDMXN?

If the price moved 1 pip (position is 1 mini of 10,000), that would equate to 1 MXN. What is 1 MXN worth in USD terms?

1 MXN /18.6615 (current exchange rate) = $0.053 or 5 cents rounded.

That does not sound like a lot when you consider the value of a 10,000 position in USDJPY is $0.96 and the value of a pip in EURUSD is $1.00.

So the value of a pip in USDMXN is roughly 1/20th of the EURUSD and USDJPY ($0.05 is 1/20 of $1.00). But isn't the USDMXN more volatile. Yes. How can you measure the volatility? I like to look at the 22-day ATR (average day range over about a month).

What is the 22- day ATR of the USDMXN?

The 22 day ATR (about a month) for the USDMXN is currently = to 2,638 pips (see chart above).

Meanwhile, the 22 day ATR for the the EURUSD is only equal to 74 pips.

For the USDJPY, the 22 day ATR is equal to 92 pips

So for the USDMXN, the value of a daily move from low to high is equal to:

2638 pips x $0.053 per pip (for a 10,000 position) = $139.814. If you bought the low and sold the high on an average day, you would make $139.81 on one mini lot (of course it is the loss if you bought the high and sold the low).

For the EURUSD at 74 pips ATR, the gain or loss from the volatility would be =

74 pips x $1.00 per pip (for a 10,000 position) = +/-$74

For the USDJPY at 92 pips ATR it would equal

88 pips x $0.97 = +/-$88.32

So, the volatility risk per mini lot, on a recent day's range is 1.88x EURUSD ($139.814/$74). That is the USDMXN - given the larger daily risk range - is nearly 2x the risk of the EURUSD (it is really 1.88 times more volatile).

For the USDJPY it is 1.58x more volatile. Why? The USDMXN normal range in a day is $139.81, The average in the USDJPY is $88.32. So the USDMXN risk is 1.58 times the risk of the USDJPY.

What does that mean for your trading? All risk being equal given current volatility, for every unit of EURUSD you normally do, you should do less USDMXN. How much USDMXN should you do?

1/1.88 = 53%

So if you do 1 mini lot of EURUSD, you should do rounded 5 micro lots (all things being equal) to have the risk tolerance. If you do 1 round 100,000 lot, you should do rounded 5 mini lots.

What about the USDJPY?

The USDMXN is 1.58 times more volatile. So if you normally do 1 mini lot of USDJPY, you should do:

1/1.58 or 0.63 or 63% of USDMXN

So if you normally do 1 mini lot of USDJPY, you should trade rounded 6 micro lots of USDMXN (all things equal) to have same/similar risk tolerance. If you do 1 round 100,000 lot, you should do 6 mini lots (60,000).

Is that it? Nope... The volatility in the USDMXN is likely to be even higher than normal tomorrow and through the election vote.

For example, today, the USDMXN is much more volatile than the EURUSD and the USDJPY. The USDMXN has a range of 4533 pip - well above the 2638 pip average. Meanwhile the EURUSD range is only at 83 pips (vs 74 pip average) and the USDJPY range is 89 pips (below the 92 pip average). If volatility is expected to continue to be much higher than normal in the USDMXN, while the EURUSD and USDJPY is "higher" but not "much higher" that implies doing even less USDMXN to keep it's risk level equal to the EURUSD or USDJPY risk level. A 5 or 6 micro lot position might only be 2 or micro lots (vs 1 mini lot of EURUSD or USDJPY).

What about Bid/Ask Spread

A thing to also consider is the bid/ask spread. If the USDMXN value of a pip is $0.05 per pip and the EURUSD is $1.00, you would expect an equivalent bid ask spread in the USDMXN to be 20x the EURUSD ($1.00 / $0.05 = 20). So,

- If the EURUSD spread is 2 pips, that would be 40 pips for the USDMXN.

- If your EURUSD bid ask spread is 1 pip the equivalent bid/ ask spread in the USDMXN should be 20 pips.

- At 1.5 pips, in the EURUSD, the USDMXN should be 30 pips.

Looking at my broker now, the spread is 1.5 pips for the EURUSD.

What is the USDMXN spread right now?

About 70-80 pips. It should be around 30 pips given the EURUSD spread.

Liquidity risk from my broker, shows that I will have to pay away much more in bid to ask spread in doing a USDMXN trade.

If there is a surprise, or if the broker simply wants to protect against an adverse price move, they can ratchet that spread up to 100 pips, 200 pips or even more depending on market volatility. That is if the range is 5000, 10,000 or even more for the day, the bid/ask spreads can go quite wide.

One final broker risk, is they may raise margin for open positions midday 9Ryan spoke to this in one of his posts). If you do not have enough capital in your account, you can be liquidated EVEN if you are in a profitable position. It is possible mathematically. So be aware.

RISK and FEAR

All these things will have an impact on your risk and your fear as well.

It will be a wild ride in the USDMXN - probably the wildest ride you may ever traded. To trade it, you need to be ready for that ride, and also understand what you are getting into (i.e. the risk). Some will be "high fiving" from their good fortune -either on a Clinton victory or Trump upset. Others will be licking their wounds (and may disappear from trading forever). My advise - if you are going to trade this pair is be solely focused on your levels, your spreads, the news, and the expectations. If you are the last one to the party, you may be right in the long run, but that may require living through a sharp correction first. It is never good to be the last one in, when others got in way before you.

In summary, the point of this lengthy post is we all trade at our own risk, but we need to have an idea what that risk really is. Sometimes, when risk is too high, it simply makes sense to sit out the dance and/or trade more normal - less risky - currency pairs. Although it sounds good on paper, does not necessarily mean it is a good trade for you.