Non trending transitions to trending..

The EURUSD is mired in a 68 pip range this week. Putting that into perspective, there has not been a more narrow range week since 2004 (there was one other 68 pip range in 2014). Moreover, the range over the last 3 days is only 50 pips.

The market is non-trending.

When the market non-trends, it will eventually transition to trend. If you know that, use it to your advantage. Anticipate a trend. PS trends are where the most money is made and lost. You just have to get the direction right.

How do you get the direction right?

The clues are in the non-trend. That is the breakout away from the 68 pip range is what you look for, and if you can trade as close to that as possible, you then use your targets - in the direction of the break - to help you stick with it.

If it breaks out and returns back into the measly 68 pip range, you have to protect against the run the other way (and go with that idea on the failure). The best case scenario is a break and a run away in the direction of the trend.

We are due for something better

The idea is that we are due for something much better than 68 measly pips. If you have that mindset at the get-go, you are in better posiition to "think trend". You are in a better position to think something much better than 68 pips. That allows you to ride the trend.

Is the range going to be 120 pips for next week? Is it 150 pips? Is it 200 pips?

I don't know. However, we can use targets, in the direction of the break to guage, how the trend is progressing. To map out the route a trend lower or higher will take us. Knowing that allows us to manage the trend with more clarity.

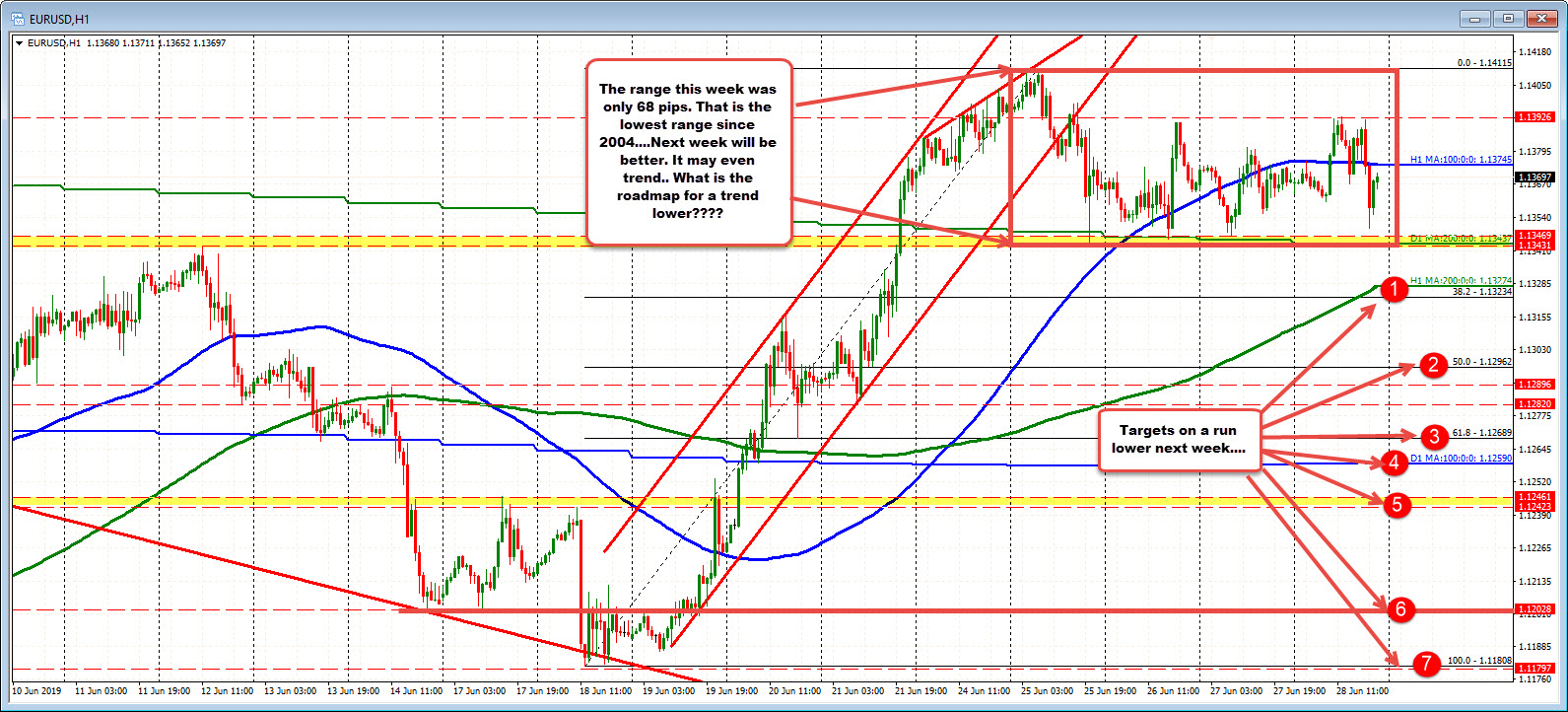

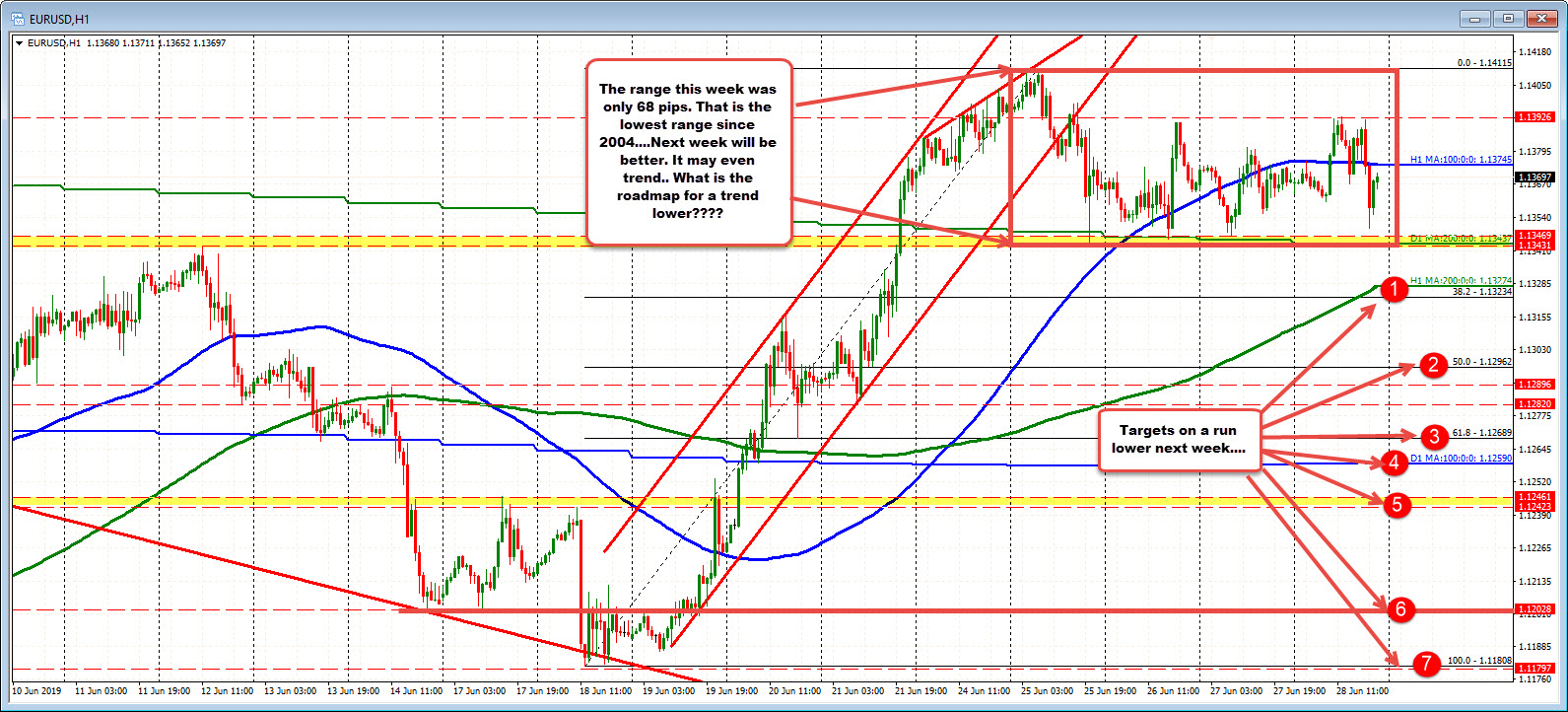

For example, if the break is lower (below the 1.1343 level, the steps (targets) would be (see hourly chart above):

- 200 hour MA and 38.2% at 1.1323- 1.1327

- 50% retracement at 1.12962.

- 61.8% at 1.12689

- 100 day MA at 1.1259.

From the current price of 1.1369 to the 100 day MA is 110 pips..... Better than 68 pips but still not great.

A move below the 100 day MA with the trend continuing could see the price target the low from June 18 at 1.11808.

That would take the range from the current level to 188 pips. Is 188 pips doable?

The highest ranges for the year in 2019 have been 207 pips, 197 pips, and 190 pips. So it might be a stretch to get all the way down there on a trend move lower.

How about 1.1242-46 (swing area - see low yellow area), or to 1.1202? A move to 1.1202 (lows from June 14 and 17) would be 167 pips from the 1.1369 level here.. That is realistic.

What about a run higher?

On the topside, a move above the 1.13927 would look toward (see the daily chart below and the green numbered circles):

- 1.1411 high from June 25.

- 1.1447 high from March 20.

- 1.1460.- 50% of the move down from the September 2019 high

- 1.15137 - High from January 31

At 1.15137, the range from the current level would be 144 pips. Is that doable? Yes.

Above that is the

5. 61.8% at 1.1544. That would be a 175 pip move from current levels.

Now, for either extension to be reached (lower or higher), it will take a near perfect week. However, after a record non-trend week, I am still going to think/antipate that something better is around the corner. We will do better much better than 68 measly pips.

I will be thinking trend. I will be targeting levels to give confidence that the trend roadmap is playing out. I will be prepared.

If you think that going into the week the market is due to transition from non-trend to trend, you have a better chance of catching the trend.

So it stinks that 68 pips was all we could do this week (and 50 pips since Wednesday), but better days (and price action) should be just around the corner. So look for it. Anticipate it. Who knows, you may catch a nice trend move in the process.

Have a good weekend.