The golden post

Here are the four basic things you need to know about trading gold. Keep on top of each of these and you are a long way to understanding what moves gold markets.

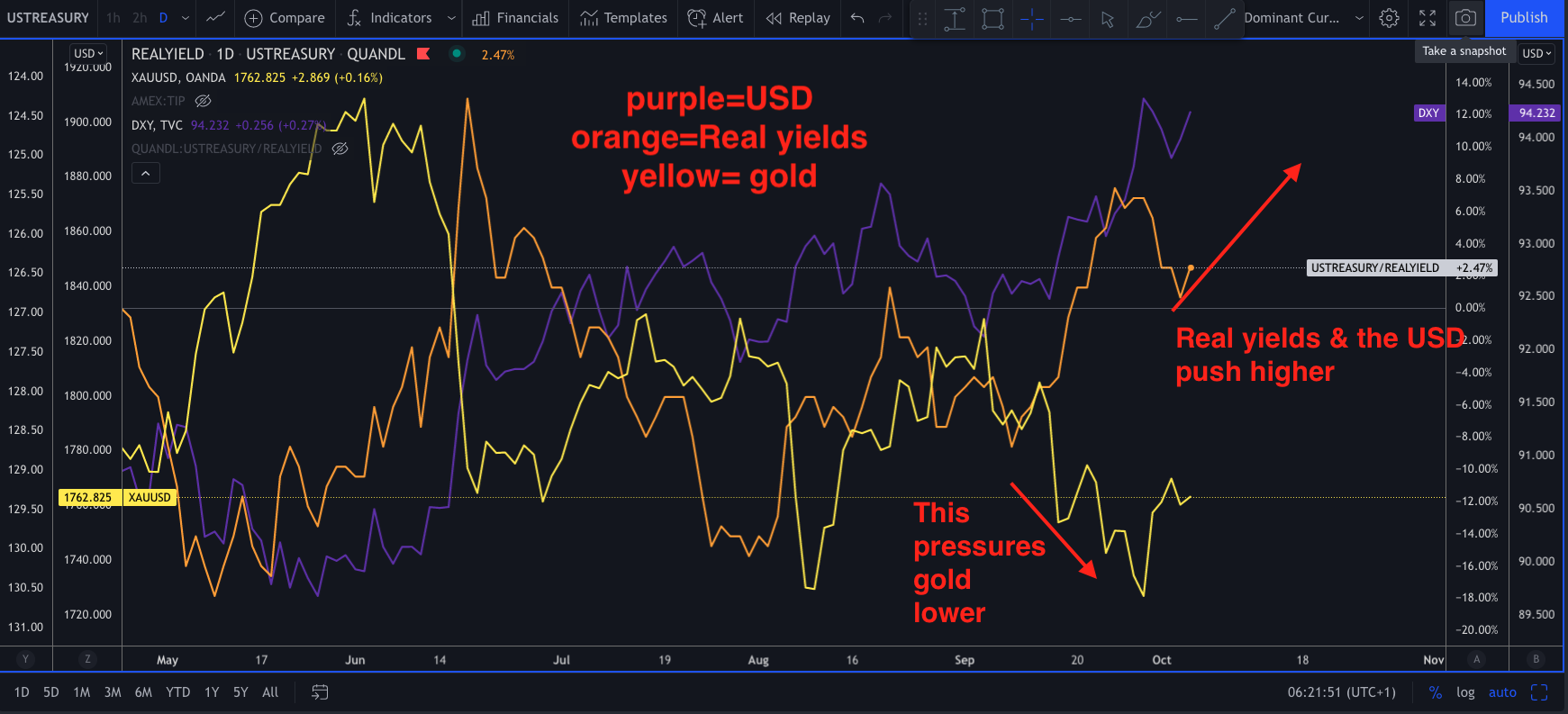

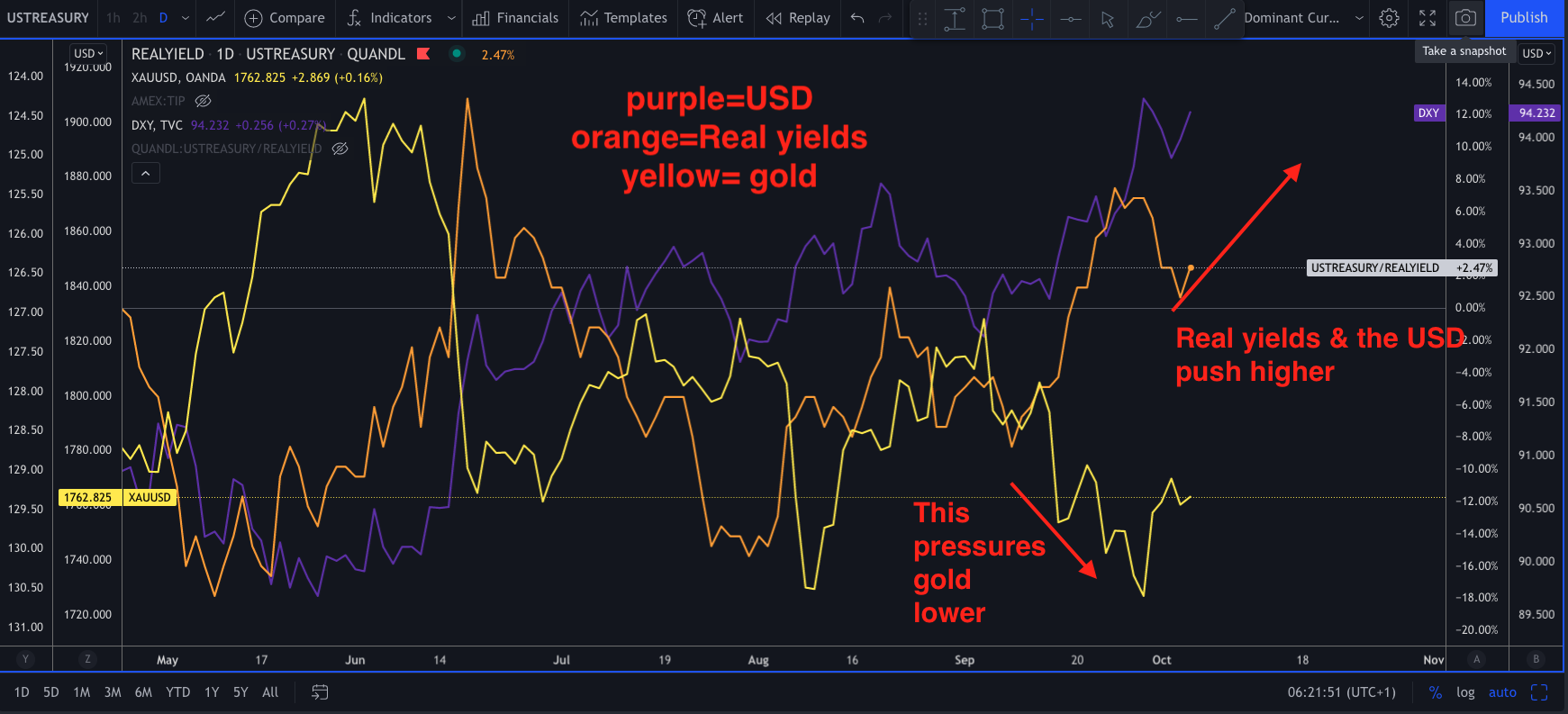

Real yields.

What are real yields? Real yields is a bond yield minus inflation.Falling real yields is good for gold, and rising real yields is bad. If inflation pressures quickly fade then that will mean real yields can start rising and that is a pressure for gold. However, look at real yields in conjunction with the USD. Ideally you want real yields and the USD moving in the same direction to get conviction on a move. See USD point below

USD

The USD has a strong impact on gold. USD strength is a headwind for gold and USD weakness is a tail wind for gold. This means that you need to have a decent understanding of what drives the USD. The USD is tricky as it has different drivers at different times. Last week, for example, the USD was being driven on different days by all three of its drivers. Safe haven demand, reflation expectations, and Fed policy shifts. See the dollar smile theory to better understand the USD drivers.

Seasonal demand

Gold tends to have storms physical demand in January and August due to physical demand for the Chinese Lunar New Year and the Indian wedding season.

ETF levels

An ETF is a type of security that tracks an index, sector, or commodity. They have become increasingly popular as financial instruments. When gold etf levels rise, that helps gold prices rise and vice versa.

Summary

If you have an eye on what these four things are doing then you will be well on the way to avoid entering the gold market at the wrong time and knowing when a good opportunity is ahead.