The lira has been trounced over the past two weeks

The Turkish lira was among the top

losers this year, losing nearly 90% of its value against the US dollar since

the beginning of the year and down over 40% in November, which marks the

currency's record monthly fall.

Extremely unfavorable conditions, such as high inflation which holds near 20%,

driven by rise in food and import prices, especially strong rise in energy

prices, prolonged supply constraints and increased costs of economic reopening

after the pandemic, kept the lira under increased pressure.

Low liquidity also contributed to lira's recent sharp moves which pushed the currency beyond any expectations and deeply into uncharted territory.

The actions of the Turkish central bank which cut the interest rates by 400 basis points since August, lowering the rate from 19% to the current 15%, with signs that the CBRT is on the way to further lower the borrowing cost in December, strongly influenced lira's performance.

The latest comments from Turkish President Erdogan, who was repeatedly accused

of with interfering central bank's monetary policy decisions and who continues

to defend rate cuts, added pressure on lira.

Erdogan pledged to win his 'war of independence' despite wide criticism of his

actions and attempts to reverse monetary easing, as the interest rates continue

to diverge from inflation that would further hurt the currency and could cause

deeper economic and monetary instability in already very fragile situation.

Market analysts are also concerned

about the Turkish currency crisis which may be contagious and quickly spread

into the most vulnerable countries Hungary and Poland, whose currencies

continue to weaken.

The threats could turn into more serious problems if the Swiss National Bank

opts for ending its intervention policy and let the franc to float free that

would further harm the local currencies, especially in the conditions of

extended risk aversion which could further inflate the franc.

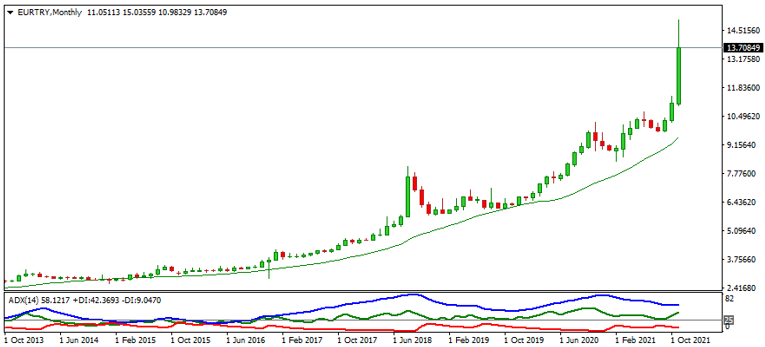

Turkish lira hit nearly 13.40 against the dollar and rose slightly above 15.00 vs the Euro, with favorable conditions for the US dollar on solid economic data, surging inflation and growing expectations for an earlier then expected rate hike, as the US central bank started reducing its massive financial stimulus, making the first step towards the start of tightening monetary policy after pandemic, suggesting that strong pressure on lira may persist.

Investors

also continue to closely watch the movements in energy prices, as Turkey is a

big oil importer and recent surge in energies, strongly contributed to lira's

weakness.

The latest drop of oil prices,

triggered by renewed fears about the global demand in light of worsened health

situation in the Europe and subsequent restrictive measures, provided temporary

relief to lira, along with profit-taking after sharp rally.

The

outlook for lira is expected to remain weak and suggesting that Turkish

currency could fall further unless fundamentals change significantly.

Pullback from new record USDTRY and EURTRY highs is likely to be a corrective

action on strongly overbought conditions on all larger timeframes

(day/week/month), accompanied with profit-taking that is expected to offer

investors better levels to -re-enter strong uptrend.

The USDTRY eyes targets at 13.8885 (Fibonacci expansion of extended third wave of the five-wave cycle from 6.8951, Feb 2021 low) and 15.0000 (psychological), while targets for EURTRY bulls lay at 15.4015 (Fibonacci 238.2% expansion of the wave from September's low at 9.7340) and 15.9630 (Fibonacci 261.8% expansion).

Solid support for USDTRY lays at 11.4375 (Fibonacci 38.2% retracement of

8.2444/13.4112 upleg) with extended dips to be contained above 10.2180

(Fibonacci 61.8% retracement), while and for EURTRY dips should be contained by

10.7080/10.6000 zone (June's peak / rising monthly Kijun-sen), before bulls

regain traction.