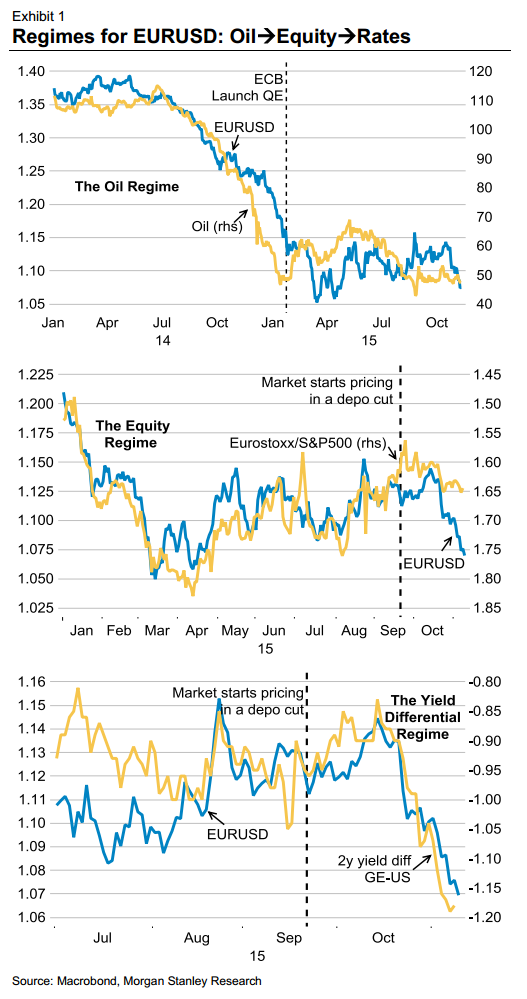

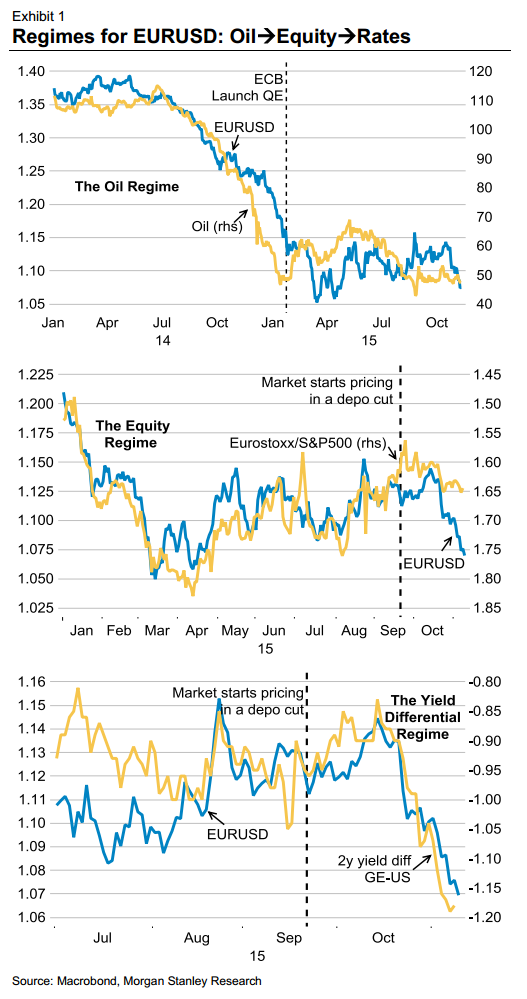

Morgan Stanley on the changing drivers for currency markets, via a look at what has been driving the euro

Before you read the research below, the key takeaway is to do an assessment of correlations across markets. Combine this with a reasonable argument for why a correlation might make sense and what you can end up with is a 'driver. Check out the quotes from MS, below, and , going forward, you can eye corss-market correlations for current drivers and how they change over time.

Currency markets are fast moving, making it difficult to keep track of what is driving exchange rates. Even over just the past year there have been many regime shifts. We have seen currencies driven by the rapid fall in oil prices, falling Bund yields as well as a rapid rise in bond and equity volatility this year.

For example in EURUSD, we have seen three distinct regimes recently (Exhibit 1). The Oil Regime:

- In 2014, weakening oil prices drove EURUSD lower via lowering inflation expectations in the Eurozone and thus increasing the market probability of the ECB launching QE.

The Equity Regime:

- As oil markets stabilized in January, the ECB's QE programme caused European equity markets to outperform.

- In the past, this would have supported the EUR, but as inflows into equities were done on an FX-hedged basis, a strong inverse correlation between EURUSD and equity markets formed.

The yield regime:

- In September when rates markets started to price in an ECB deposit rate cut, the equity correlation started to break down. Markets started to price in an ECB deposit rate cut and so strengthened the correlation between EURUSD and relative short-end yields.

The graphs MS are referring to: