Market picture

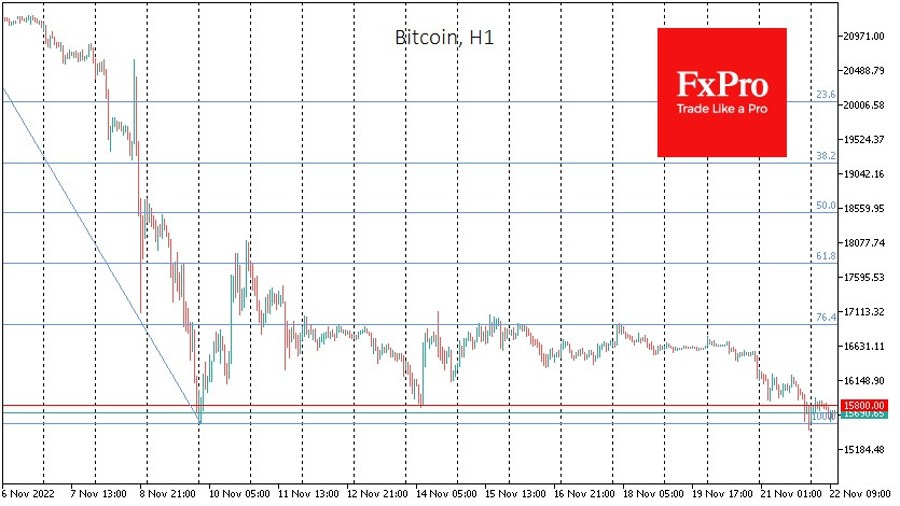

Bitcoin went below 15,500 at the end of the day on Monday, rewriting two-year lows, and slightly retreated from those extremes by the start of trading in Europe, trading around 15,700 (-2% in 24 hours). Ethereum is updating lows from July at the time of writing, falling to $1072 (+3.5% in 24 hours).

The crypto market capitalisation is down 1.75% overnight to $782bn, its lowest since January 2021. Although this indicator is very tentative and synthetic, we have seen a tug-of-war around $1 trillion for a long time. For a while, the market lingered near levels just above 830 - the high at the peak in January 2018. Now another belief that the previous peak of the last cycle would work as insurmountable support has been broken.

The crypto market capitalisation has gone sharply down, failing to develop an offensive above its 200-week average by early November. The 200-week (4-year) period is consistent with the notion of cycles in crypto, and the situation now looks like the exit of leveraged speculators who thought crypto had bottomed out in June-October.

Although we believe that squeezing the weak hands out of the sector is almost complete, we are now seeing nothing more than speculators deleveraging, which is generally healing the market. Technical analysis suggests capitalisation could fall as much as 400-450bn, nullifying the rally, before returning to growth. However, this technical picture looks excessively pessimistic, and the stingiest speculators might not wait for that entry point, as is often the case in the markets.

News background

According to CoinShares, investments in cryptocurrencies rose by $44m last week against inflows of $42m the week before. Bitcoin investments rose by $14m, while Ethereum fell by $1m. Investments in funds that allow shorts on bitcoin increased by $18m, while shorts on ETH increased by a record $14m. Inflows to "short" products were 75% of the total, suggesting a deeply negative sentiment amid the FTX collapse, CoinShares noted.

According to IntoTheBlock, the share of unprofitable bitcoin addresses exceeded 51% (24.56 million addresses out of 47.85 million BTC holders). The last time a similar situation was observed was after the market crash in March 2020.

Rumours have emerged in the cryptocurrency community about possible problems at another major company. The failure of digital asset manager Grayscale Investments to disclose reserves and the suspension of crypto lending operations by OTC platform Genesis Trading have raised concerns about the entire Digital Currency Group (DCG) sustainability. According to experts, the collapse of Grayscale would be more severe than the collapse of Three Arrows Capital.

This article was written by FxPro’s Senior Market Analyst Alex Kuptsikevich.