The first trading day of the year the financial markets had a party like no other, with new record highs for the USA30 and USA500. Equities were glorified to kick off 2022 action as bond bears were in full control, making this the worst start to a year since 2009.

Longer dated maturities suffered the brunt of the selling as investors concluded the market yields were way too low given inflation risks and a potentially aggressive Fed tightening scenario, but Wall Street picked up steam with energy, consumer discretionary and financial sectors leading gainers, while healthcare and real estate lagged.

Wall Street has climbed, paced by the USA100’s near 1% surge with Apple’s gains boosting the company to a $3 trillion market cap, as the coronavirus pandemic keeps boosting tech giants. Apple’s market capitalization is now well above the combined value of all the blue chips listed on London’s FTSE 100.

Firms like Apple have skyrocketed since the pandemic crash, as e-commerce, cloud services, social media, devices required to work from home and the like are all in high demand and will remain so for the foreseeable future.

But it is not only that; despite the recession due to the pandemic tech giants kept investing heavily in research and development and proceeded to make several acquisitions in order to dominate markets. These are old strategies that seem to have borne fruit even during the pandemic (e.g. Apple bought a VR company on May 2020).

Hence overall sentiment remains positive, as markets continue to buy into the recovery story, which is also underpinning a rise in yields and outpinning stocks. Apple’s move marked an appreciation up to 41% since January 2021, while it tripled its price since the pandemic lows of March 2020, adding around $2 trillion in market capitalization.

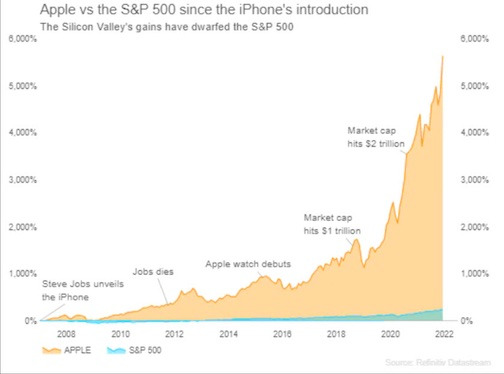

What’s even more remarkable is Reuter’s articles reminding us that: “Apple’s shares have climbed around 5,800% since co-founder and former Chief Executive Steve Jobs unveiled the first iPhone in January 2007, far outpacing the S&P 500’s gain of about 230% during the same period.”

#Apple rose +2.50% yesterday, and spiked to $182.86. Strong rising positive momentum remains intact, regardless of the tide pullback seen in early December. The RSI holds close to the 60-70 area, while MACD lines are well above neutral zone suggesting the prevalence of bulls in the medium term.

Since 2021’s resistance has already been hit and broken, if the bulls take the upper hand and continue the recent move next resistance for the asset could come at 185.00 (200-week EMA), and at 192.00 (100.0% FE). On the other hand, the pullback looks to be just a correction in the short term with 172.00 (61.8% FE) and 167.60 (December’s low and daily lower BB) providing a floor to the asset.

In general, stocks tend to gain at the start of a new year, as new cash flows in from the likes of pension funds and investment managers. All may not be rosy for equities in 2022 however, as investors will have to contend with ongoing pandemic uncertainties, and most likely interest rate increases from the Fed.

However, if the Fed manages to restrict inflation as expected in the first half of 2022 and there are no further pandemic surprises US and global equity markets would be poised to extend their gains for a fourth straight year, especially high-dividend paying ones.

Click here to access our Economic Calendar

This article was written by Andria Pichidi, Market Analyst.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.