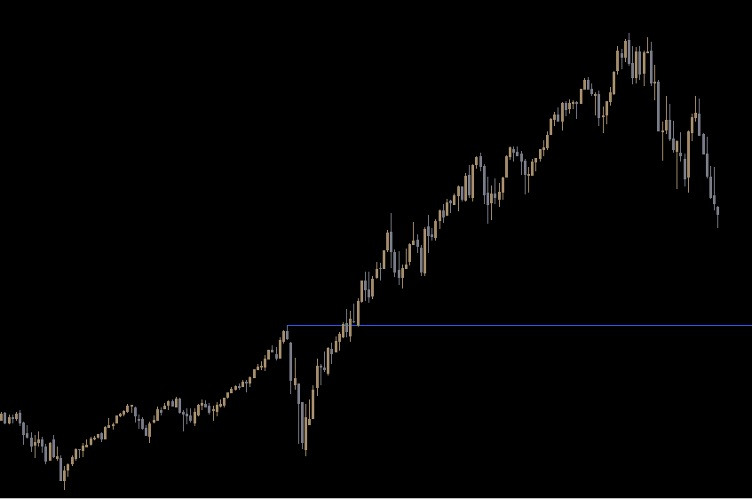

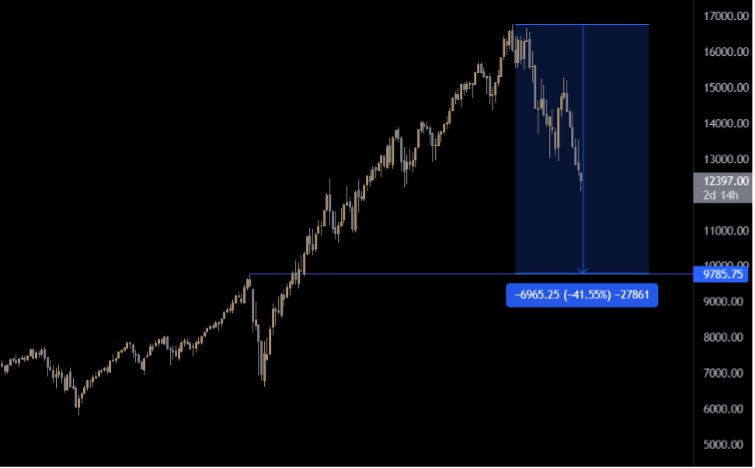

The Nasdaq index correcting to its pre-covid high would be something, right? It would be a 41% drop from its all time high, more than the 31% drop when the covid crisis hit. The question is can it go that much low?

The current economic environment is certainly bad for the stock market with recession risk, highest inflation in decades and the Federal Reserve tightening monetary policy aggressively raising rates by more than the usual 25 bps and shrinking its balance sheet faster than it did the last time in 2018.

In fact, if we take the 2018 as a rough guide when there was an economic slowdown from US-China trade war and the Fed raising rates and conducting QT, we can see that the stock market hasn’t done quite well ending the year in negative territory. It bounced back once the market started to expect the Fed to reverse course amid the growth slowdown and the losses in the stock market.

This time though the Fed is solely focused on fighting inflation that in March hit a 41-year high. Price stability is a central bank mandate and an absolute priority if it wants a stable economic environment. They may sleep through a falling stock market, but they would get nightmares if inflation expectations deanchored as that would require an even greater economic pain.

So, is it possible that the Nasdaq falls to its pre-covid highs? Yes. Can we be sure? No. Setting targets is not something I like to do because the only thing we can control is the risk and not the reward. As long as the reasons for the market to fall hold, then we can see it continuing in its bear market fashion with the usual downward ebb and flow. You also need to remember that the market is a discounting machine, it prices in future expected outcomes. Right now, the result of all this mess is a recession/stagflation.

Another paramount thing to remember is that liquidity drives the stock market and right now and for the next 6/12 months the Fed is raising interest rates in an “expeditiously” way and shrinking its balance sheet faster than it did in 2018.

As Stanley Druckenmiller once said “frankly, even today, many analysts still don’t know what makes their particular stocks go up and down. Earnings don’t move the overall market; it’s the Federal Reserve Board. Focus on the central banks and focus on the movement of liquidity. Most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets."

This article was written by Giuseppe Dellamotta.