India’s stock index is looking at it’s biggest loss since September 2011 as it falls 4.2%. The moves come as the rupee also hits a record low. Last Friday they also fell as the Indian government looked to place capital controls on companies and individuals to stem the flow of funds out of the country. They have also hiked customs duty on Gold and increased short-term borrowing costs to counter the volatility in currency speculation.

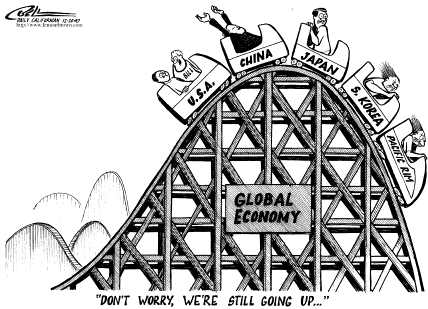

Now I’m no expert on India but as one of the emerging market countries, and as reader kamalpushap pointed out, it is facing lower growth prospects. Adam recently noted the same also The #1 most under-reported story this year. Previously I’ve said that global economies are on a roller coaster of a growth story. The front of the coaster saw the UK dip then the US then Europe and as those three now look to start climbing up the dip those in the back like China and the EM’s are just coming down the hill.

But it’s not just the growth issue that will hit emerging markets. They will also feel very strong shock waves from the US Fed. As the cheap money flooded into the market it looked for better returns offshore, and where better to go than high yielding, high growth prospecting economies. The affect of this on some emerging markets was very large and now that the taps are forecast to turn off there will be big effects seen in reverse on these markets.

This is one of the fears behind India’s move on capital controls. Most economies like India welcome the influx of foreign investment and money into the country but they are less than pleased when that money and investment looks to pack up and leave.

So emerging economies are going to be facing a double whammy. Growth is falling and the investment money that has and would have continued to help that growth is booking a taxi for the airport.

The long drawn out arguments on the unknown effects of QE are now starting to come out but as usual it is likely to be too late to do anything about it.

Hold on tight!