Economics is as much about mass psychology as dollars and cents.

If Japanese people believe a recovery is coming and inflation is on then consumers will spend more, companies will invest and it will be a self-fulfilling prophesy. That faith was a key tenant of Abenomics and the radical policy to double the monetary base.

The 80% stock market rally in 2012-2013 was proof the strategy was working but in the last year the momentum has stalled an consumers are falling back into their old comfort zone. The latest BOJ survey of public opinion shows some troubling trends.

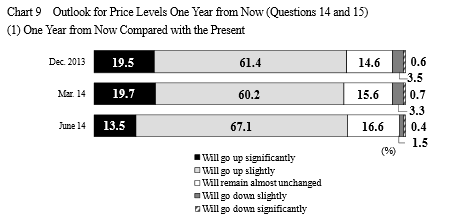

The percentage of people who said they expect prices “will go up significantly” over the next year has been falling — to 13.5% in the June survey from 19.7% in the previous quarterly survey in March. The portion that expects prices to go up “significantly” over the next five years has also shrunk, to 26.0% in June from 29.4% in December.

BOJ survey

The trend is consistent across the survey with consumers less optimistic about prices and the economy