Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday September 9 2014:

- EUR net short 158K vs short 162K prior

- JPY net short 101K vs 118K short prior

- GBP net long 27K vs long 10K prior

- AUD net long 41K vs long 49K prior

- CAD net long 11K vs long 13K prior

- CHF net short 14K vs short 13K prior

- NZD net long 10K vs long 10K prior

- Full report

Speculative traders were on the wrong side of the pound trade for the past few weeks but they doubled down on Tuesday on expectations that the United Kingdom will remain united. I like that bet but it’s a risky one ahead of Thursday’s vote.

Otherwise there was some mild profit taking in US dollar longs, especially against the yen. That was probably the wrong place to take it this week with the pair finishing the week near the highs.

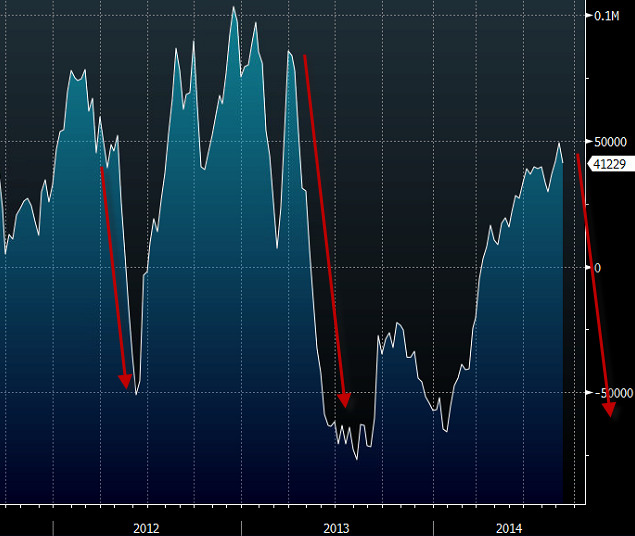

The real pain this week was in the Australian dollar. That little bit of carry doesn’t seem so great with the aussie falling +3% on the week. Look for a scramble out of those longs in next week’s data.

Runs on the Australian dollar tend to be very quick as carry trades are unwound.

AUD CFTC net