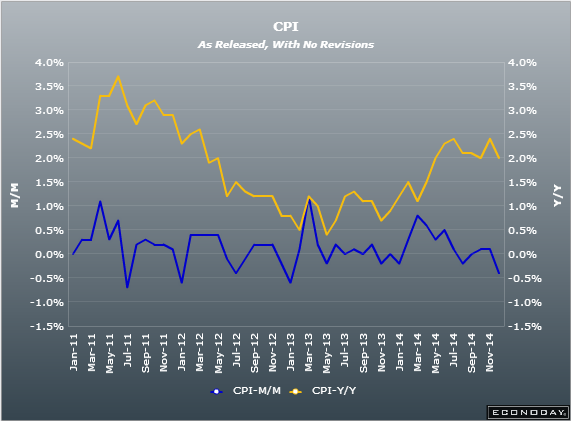

- Prior 2.4%

- -0.4% vs -0.2% exp m/m. Prior +0.1%

- Core 2.0% vs 2.0% prior y/y

- -0.3% vs +0.4% prior m/m

- BOC Core 2.1% vs 2.4% exp. Prior 2.3%

- -0.2% vs +0.1% exp m/m. Prior +0.3%

USD/CAD runs up t the days high at 1.1634 as inflation comes in much softer than expected. The drop in the core number is especially noteworthy. Update: It should be noted that the non-BOC core held steady at 2.0%

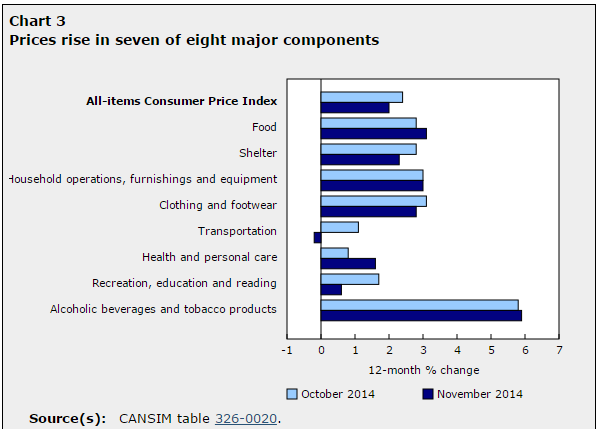

Gasoline the main driver dropping 5.9% y/y following a 0.6% rise on October. It was down 7.5% on the month and posted a 5 straight fall. Big falls seen in gasoline but other energies saw rises. Nat gas +14.7%, electricity +3.6% y/y

Canadian CPI data 19 12 2014

With gasoline prices dropping rapidly we need to look for the pass through effects into the rest of the economy.

On the plus side for the BOC, the fall in the core will somewhat validate BOC head Stephen Poloz and his view of lower inflation.

Canadian CPI 19 12 2014