The consensus view in 2015 is that the US economy will accelerate to 3% growth for the first time since 2005. Then again, every year seems to start out this way.

At the start of 2014, the Fed was forecasting 2.8-3.2% growth for the year but we finished the year around 2.35%. It’s been a recurrent pattern of serial disappointment.

This time, as they often say, is different. The jobs market has clearly gained strength over the past year and several metrics are looking up.

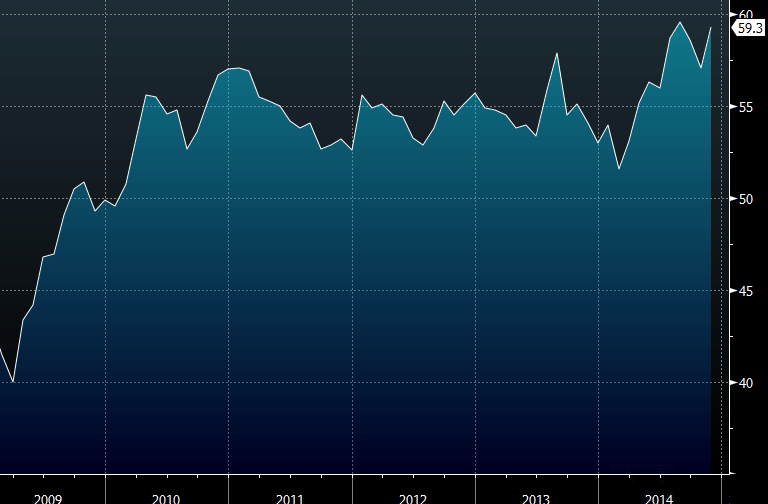

One of them is the ISM non-manufacturing index. It’s a key measure of the strength of the service sector and a forward-looking indicator.

ISM manufacturing index

In the final two quarters of the year, it accelerated to the best levels since 2005, which not-coincidentally was that year of 3% growth.

The next report — which is for the key retailing month of December — is due on Tuesday at 1500 GMT (10 am ET) and the consensus estimate is for a slip to 58.0. Forecasts range from 56.0 to 59.8.

For the market, a reading above 60 would spark talk about Fed rate hikes, perhaps as soon as April and that would light another fire under the US dollar. A reading near 56.0 would remind markets of the serial disappointment of the past but ultimately, even at 2.2% growth, the US economy is still performing better than most of its rivals and that will make US dollar dips a buy.