Highlights of the Bank of Canada’s monetary policy report for January 2015

- The sharp drop in global crude oil prices will be negative for Canadian growth and underlying inflation.

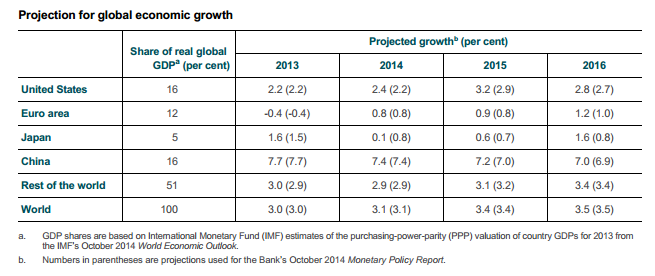

- Global economic growth is expected to pick up to 3 1/2 per cent over the next two years.

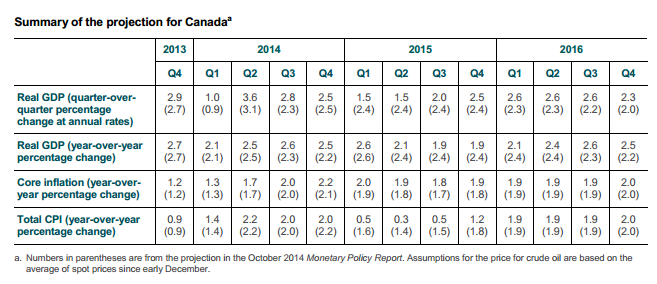

- Growth in Canada is expected to slow to about 1 1/2 per cent and the output gap to widen in the first half of 2015.

- Canada’s economy is expected to gradually strengthen in the second half of this year, with real GDP growth averaging 2.1 per cent in 2015 and 2.4 per cent in 2016, with a return to full capacity around the end of 2016, a little later than was expected in October.

- Total CPI inflation is projected to be temporarily below the inflation-control range during 2015 because of weaker energy prices, and to move back up to target the following year. Underlying inflation will ease in the near term but then return gradually to 2 per cent over the projection horizon.

- On 21 January 2015, the Bank announced that it is lowering its target for the overnight rate by one-quarter of one percentage point to 3/4 per cent.

USD/CAD blasted up to 1.2276 from 1.2048 on the surprise move

GDP has been mostly lowered across 2015 and raised for 2016

- 2015 GDP Q1-4 were all 2.4% and are now revised to; 1.5%, 1.5%, 2.0% & 2.5%

- 2016 Q1-4 has been revised to; 2.6%, 2.6%, 2.6%, 2.3% vs 2.3%, 2.3%, 2.2% & 2.0% in October forecasts

On CPI they see headline inflation dipping in the early part of 2015 before going back towards target later in the year and into 2016. Perhaps surprisingly they see the core number staying relatively stable through the same period.

BOC forecasts Jan 2015

On the global picture they’ve revised up US growth forecasts to 3.2% from 2.9% for 2015 and 2.8% vs 2.7% prior 2016. Global growth remains unchanged at 3.5%

BOC global growth forecasts Jan 2015

The full report can be found here