FXCM has released a statement and is raising foreign exchange and gold margins. They say the changes may be revised at a later date and warned that tomorrow’s ECB decision and the Greek election on Sunday could cause volatility.

They also stress that the company hasn’t filed for any form of bankruptcy and is in compliance with regulatory capital requirements in all jurisdictions.

Sources report that all accounts will be brought to 1:50 by Friday, some down from as much as 1:400, depending on the jurisdiction. Clients are likely to get notices asking them to close positions to be in compliance.

Traders want to know what FXCM is doing about negative client balances. We urge them to forgive those balances so the industry can move on. However, every press release that doesn’t make that commitment makes it less and less likely.

NEW YORK, Jan. 21, 2015 (GLOBE NEWSWIRE) — FXCM Inc. (NYSE:FXCM), a leading online provider of foreign exchange, or FX, trading and related services, today announced that starting Wednesday, January 21, 2015 the firm will increase margin requirements globally on forex instruments, as well as gold in its overseas jurisdictions. The new margin requirements for its overseas jurisdictions will be consistent with the firm’s most conservative margin requirements currently in place for clients of Forex Capital Markets, LLC, its U.S. entity. These margin requirements may be adjusted at a later date and clients are encouraged to continue to read all firm communications.

FXCM believes, at this time, there is a high level of uncertainty in the currency markets that could destabilize markets throughout 2015.

There are two major upcoming news events which may cause significant volatility: the ECB Bank Rate Decision on Thursday and the Greek Election on Sunday. FXCM’s decision to increase margin requirements is in order to protect clients during extreme market volatility.

“FXCM would like to reiterate that trading on FXCM’s systems continues in the normal course of business,” said Drew Niv, CEO of FXCM. “It is important to stress that FXCM is not insolvent, has not filed for any form of bankruptcy, and is in compliance with all regulatory capital requirements in the jurisdictions in which it operates,” he added.

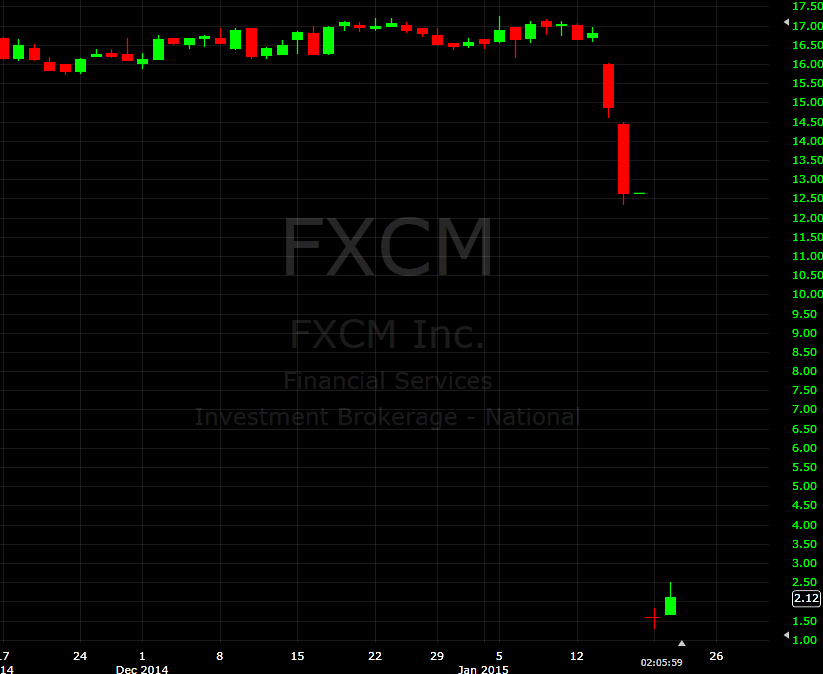

Shares of the company have rebounded today but have been decimated since they announced a $225 million loss on the SNB. If they choose not to forgive client balances I sincerely hope that clients abandon them and the share price goes to zero.

FXCM daily chart

Update: This is from the comments, ads like this will make it very hard for FXCM to collect negative balances.