Central bank watch June

Bank of England, Governor Andrew Bailey, 0.10%, Meets August 05

Up until this weeks meeting there had been two up beat central bank meetings from the Bank of England. It could have been anticipated that this would really have increased the odds of a hawkish twist from the BoE. Heading into the Bank of England meeting Sonia futures were pricing in a more optimistic Bank of England with interest rates projected to rise next year. However. The actual meeting itself was a disappointment. The only dissenter to the headline prints was Andy Haldane who voted to taper asset purchases. The vote was 8-1 in favour of tapering. However, this was Andy Haldane's very last MPC meeting, and a lack of hawkish comment left the GBP stop sell off fairly quickly out of the meeting.

Inflation was considered transitory, so no need to raise rates quickly. The high inflation print from May was acknowledged as being 'above the 2% target' (it was 2.1%). Growth expectations were revised higher by 1.5% with a strong recovery noted in the consumer facing services for which restrictions were loosened in April.The hot housing market, which could have had the BoE act to contain,was merely seen as 'strong'. So, no worries there from the BoE.

The meeting as a whole was a very holding affair and August is now seen as the key date for the MPC to 'fully assess the economic outlook'. Perhaps the BoE will taper next time?One thing for certain is that it now needs Vlieghe and Ramsden to quickly fill the absence of Haldane's hawkish shoes if the BoE are going to move towards tapering.

You can read the full statement here

Swiss National Bank,Chair: Thomas Jordan, -0.75%, Meets 23 September

The SNB interest rates are the world's lowest at-0.75% due to the highly valued Franc. As an export driven economy they hate a strong CHF and are doing their best to make it as unattractive as possible. The market generally ignores this and keeps buying CHF on risk aversion which has been here in one form or another since around 2008/2009 accroding to the EURCHF chart The SNB hate this and repeat, as they did in the latest meeting, that the 'Swiss franc remains highly valued'. However, recent prices mean the EURCHF long term floor does look in place.

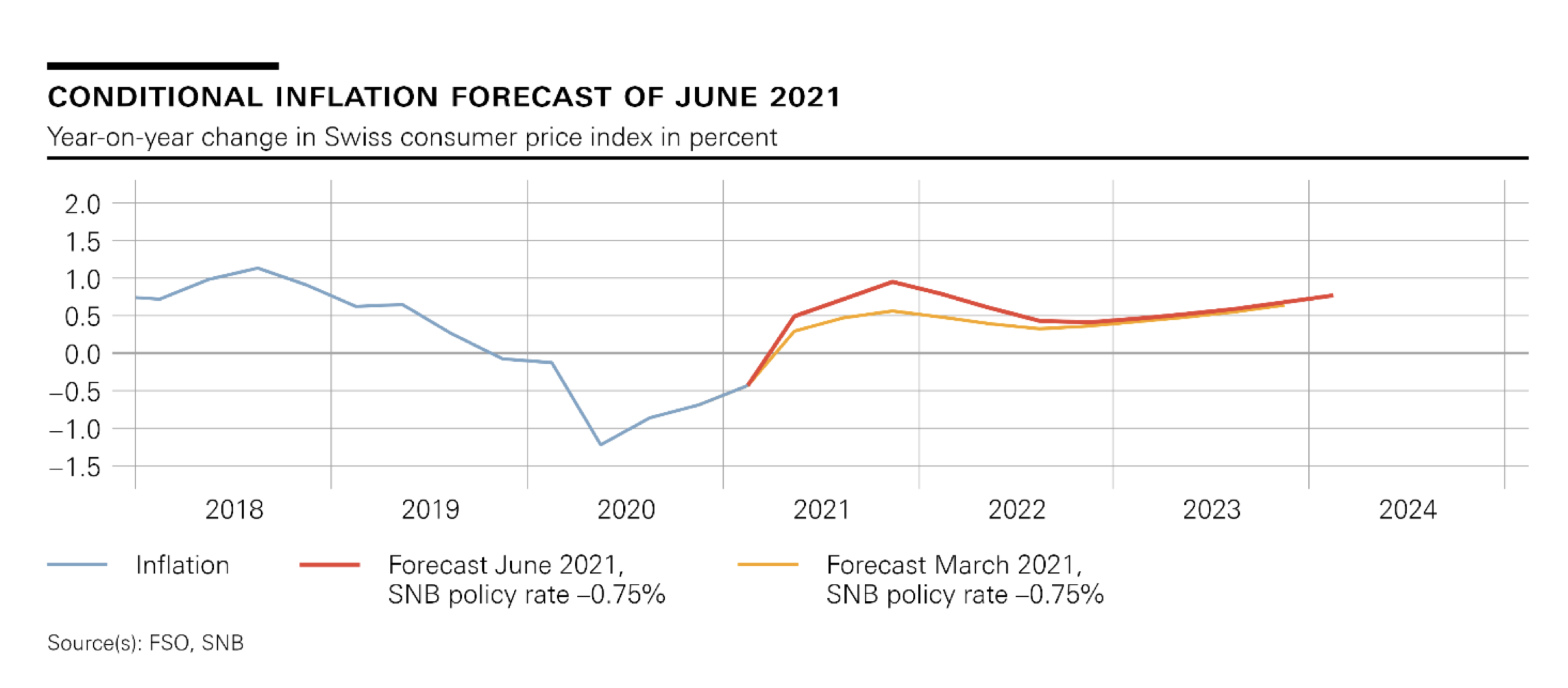

On their June 17 meeting the SNB left rates unchanged. The inflation forecasts were revised higher again. The reasons cited had increased too from the previous meeting. In the March meeting it was only oil related products that were mentioned. In the June meeting it expanded to 'higher prices for oil products and tourism-related services, as well as for goods affected by supply bottlenecks'. The new forecast stands at 0.4% for 2021, and 0.6% for both 2022 and 2023. The conditional inflation forecast is based on the assumption that the SNB policy rate remains at −0.75% over the entire forecast horizon. Watch out for high inflation to possibly prompt the SNB into action, but note that we are no where near that now.

In terms of growth the SNB was far more upbeat. In the March meeting they projected growth of 2.5% -3%. In the June meeting they noted that the economic indicators had improved significantly of late. Growth for 2021 is now seen at around 3.5 mainly due to the lower than expected decline in GDP in Q1. The statement struck a tone of optimism vs 'who knows what will really happen. However, a more optimistic note was found in the statement.

The SNB will continue to intervene in the FX markets. The Swiss are always mindful of the EURCHF exchange rate because a strong CHF hurts the Swiss export economy. This is why the opening paragraph, and sentence number two, reads : 'Despite the recent weakening, the Swiss franc remains highly valued' . The SNB want a weaker CHF. The rest of the world wants CHF as a place of safety in a crisis, so we have this constant tug of war going on.

For more details on the sight deposits check out SNBCHF.com, This site called the removal of the floor back in 2015, so well worth checking out.

Note that a currency like the EUR could offer some decent upside against CHF over the coming months as the ECB prepare to taper. The SNB are still content to be the lowest of the central bank pack and dissuade would be investors by charging them for holding CHF. EURCHF for a 6-12 month hold is worth considering and just checking in with the ECB and SNB policy shifts. GBPCHF on dips is attractive too.

Bank of Japan, Governor Haruhiko Kuroda, -0.10%, Meets July 16

The Bank of Japan remains a very bearish bank and there is no sign of exiting from its easy monetary policy.The latest meeting saw no surprises and everything was expected in the June 18 policy meeting. The headlines were as expected with Interest rates remaining at 0.10%. In a similarly unmoved fashion the Yield Curve Control (YCC) was maintained to target 10 year JGB yields at 0.0%. The vote on YCC was made by 7-1 votes with Katoaka the dissenter and Masai the abstainer.

The general outlook is that the economy is seen to be improving. The BoJ noted that, 'exports and industrial production have continued to increase steadily. In addition, corporate profits and business sentiment have improved on the whole'.

There was a new funding scheme announced to help firms adapt to greener climate demands in the future. 'the Bank judged it appropriate to introduce a new fund-provisioning measure, through which it provides funds to financial institutions for investment or loans that they make to address climate change issues based on their own decisions'.

inflation was revised up fractionally, but low inflation has dogged the BoJ for years and they are a long way off their 2% target.

- Japanese National CPI (May) -0.1% y/y vs. Exp -0.2% (Previous -0.4%)

- Japanese National CPI Ex. Fresh Food (May) 0.1% y/y vs. Exp 0.1% (Previous -0.1%)

- Japanese National CPI Ex. Fresh Food & Energy (May) -0.2% y/y vs. Exp -0.3%

The only thing to say is that there is no change to the perspective that the Bank of Japan is ready to step in to support Japanese equity markets if they are needed to. Aside from this there is no change expected for the foreseeable future. Be aware that the JPY continues to operate as a safe haven currency and in times of financial stress and worry the JPY tends to find buyers. The AUDJPY is the go to risk on / risk off currency pair.

You can read the full statement here.

Reserve Bank of New Zealand, Governor Adrian Orr,0.25%,Meets July 14 2021

The interest rate at the last RBNZ rate meeting were unchanged, the interest rate was kept at 0.25%, but crucially a rate hike was signalled for 2022. Remember that the name of the RBNZ rate decision has changed from OCR (Official Cash Rate) to MPR (Monetary Policy Review). The reason for the change is that other tools such as forward guidance and LSAP, not just the OCR, are being deployed to achieve the Monetary Policy Committee's (MPS) mandate of low and stable inflation and full employment. So, if you see a MPS/MPR announcement that is referring to what used to be the OCR statement. Confusing and annoying? Yes, but that's a name change for you.

This policy shift resulted in some immediate upside in the NZD. Governor Orr took the view that some of the more extreme risks were off the table. However, there was a tentative note to his decision where he stated that the rate hike projection for September 2022 was highly conditional. The reason for the caution was what you would expect. COVID-19 containment dependent. Much of what was said can be summarised by one simple quote from the MPS statement, "The sustainability of the global economic recovery remains dependent on the containment of COVID-19".

Inflation

The RBNZ were very unconcerned about inflation.Inflation was put down to the usual suspects of higher commodity prices, higher oil prices, and pressure on shipping arrangements. The RBNZ expect these pressures to alleviate over the course of this year.