Who is going to back away from rate hikes first?

Three central banks are in focus right now because they have hawish stances that are at risk. The ECB, Fed and BOC.

The market thinks any of them could shift at any moment.

It's a horserace.

The BOC is up first with the meeting on Dec 5 but they might want to wait for the Fed before sending any kind of signal. They also have a bit of help from the Federal government now. Plus the data has held up. They're not going to hike but they won't signal a pause either. The market right now is pricing in 77% for January, which strikes me as high.

The ECB meeting is Dec 14 but Draghi and some other top officials speak before then. Earlier today, consumer confidence fell to its lowest since March 2017 and the ECB's Visco recognize the trouble. The issues is that the ECB has a well-earned reputation of waiting until the last minute to make up its mind and they still have time to punt.

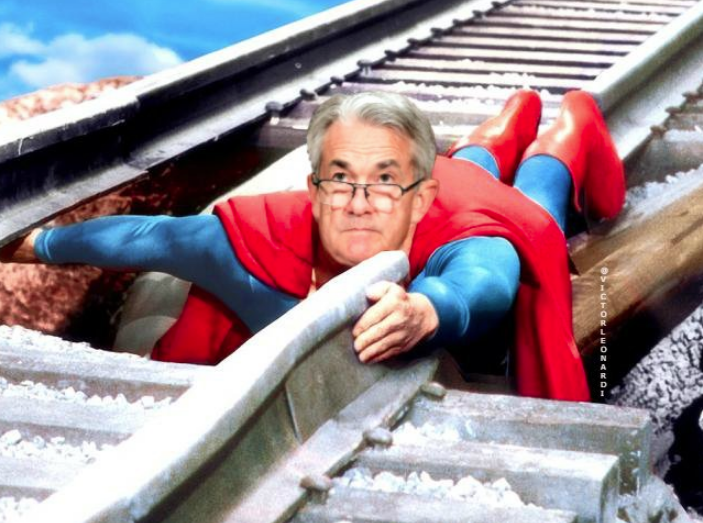

The Fed meeting is Dec 19 but next week we hear from Powell,

who is slated to speak on the economy. I expect that a hike is a done deal but

a signal of a pause afterwards would solve a lot of problems because it would weaken

the dollar. With oil much lower, you also have far less pressure on headline

inflation so that's the justification.