The Bank of Japan monetary policy meeting has concluded

THIS IS BIG NEWS FROM THE Bank of Japan

- BOJ eases monetary policy further

- Adopts negative interest rate policy, to charge interest for excess reserves financial institutions park with BOJ

- Adopts negative 0.1 pct interest for excess reserves financial institutions park with BOJ

- BOJ decision on negative rates was made by 5-4 vote

- Maintains pledge to increase monetary base, its main policy target, at annual pace of 80 trln yen

- Decision on monetary base was made by 8-1 vote

More

- BOJ's median core cpi forecast for fiscal 2016/17 at +0.8 pct vs +1.4 pct projected in oct

- BOJ's median core cpi forecast for fiscal 2017/18 at +1.8 pct vs +1.8 pct projected in oct

- BOJ's median core cpi forecast for fiscal 2015/16 at +0.1 pct vs +0.1 pct projected in oct

- BOJ expects to meet 2 pct inflation goal around first half of fiscal 2017

BOJ's price estimates based on view crude oil expected to rise from recent $35 per bbl to over $40 towards end of projection period

quick headlines via Reuters

More (I may have repeated myself a little with some these):

- BOJ to charge interest for excess reserves financial institutions park with BOJ

- Will cut interest rate further into negative territory if judged necessary

- Negative interest rate will be adopted in tandem with QQE

- No change in BOJ's base money target of 80 trln yen

- Will introduce 3-tier system on rates

- Will aim to lower short end of yield curve, exert further downward pressure on rates via combination of negative rate, large-scale JGB buying

- BOJ pushes back timing for achieving its 2 pct inflation target in quarterly report

- Japan CPI likely to reach 2 pct in first half of fiscal 2017/18

- Will adopt zero rate for its loan support programme, fund-supplying operations

- Makes no change in pace of JGB, ETF, J-REIT purchases

- Will examine risks to econ, prices, take additional easing steps if needed using quantity, quality, and interest rate

Acted to preempt manifestation of risk of market volatility hurting business confidence

-

Added:

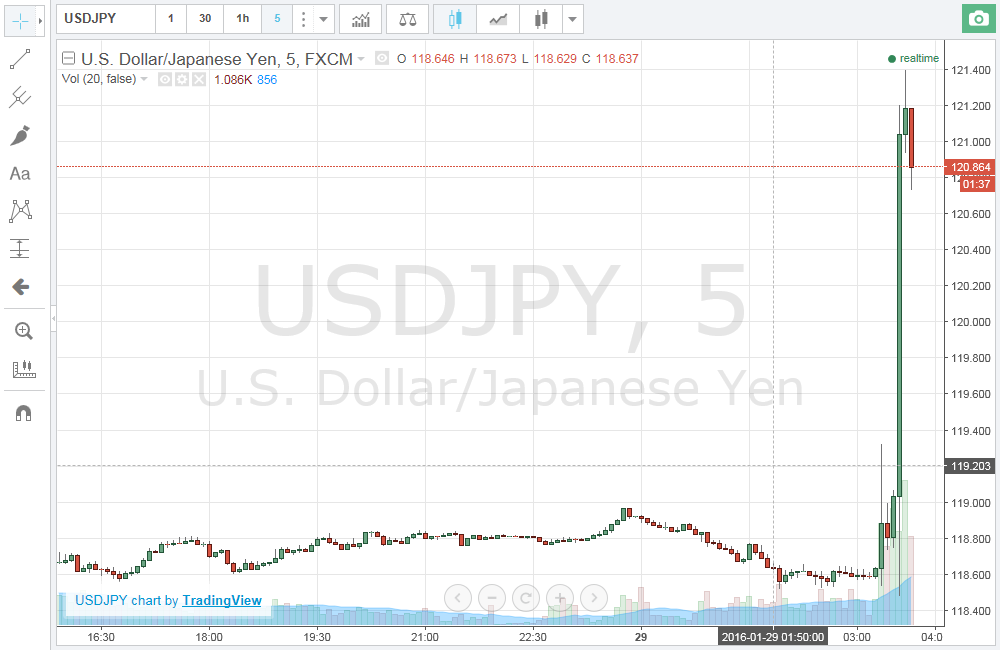

The USD/JPY moves:

-

-

And, still to come later, Bank of Japan Governor Kuroda's press conference due at 0630GMT