Its been a busy week from the RBA, now its the February 2019 SoMP

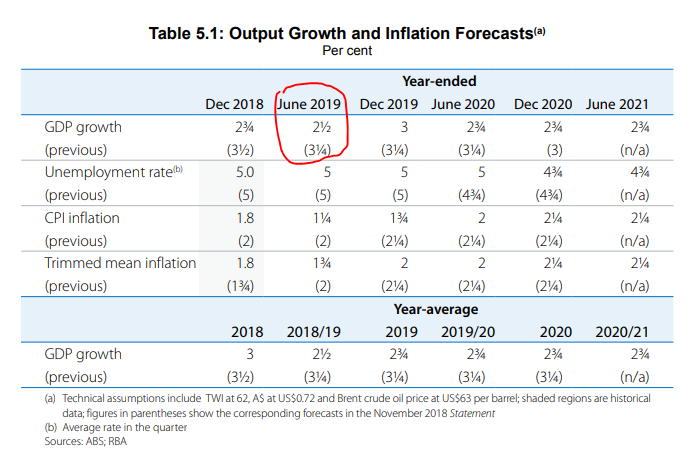

The RBA has taken an axe to its GDP forecasts … check out the June 2019 slash to 2.5% from 3.25%. About time they got real TBH:

- Probability of rate rise or cut more evenly balanced than previously

- board does not see strong case to move rates in the near term

- board judges progress on inflation, unemployment can be "reasonably expected"

- if progress is made, higher rates would be appropriate at some point

- might lower rates if there was a sustained rise in unemployment, too low inflation

- resilience of household consumption is a "key uncertainty"

- unsure whether income growth will rise enough to offset drag from falling house prices

- household reaction to fall in home prices is a "significant uncertainty"

- cuts GDP forecasts, sees 2.8 pct y/y Dec 2018, 3.0 pct Dec 2019, 2.7 pct Dec 2020, 2.7 pct June 2021

- lowers inflation forecasts, trimmed mean at 2.0 pct y/y Dec 2019, 2.1 pct Dec 2020, 2.2 pct June 2021

- sees unemployment at 5.0 pct Dec 2019, 4.9 pct Dec 2020, 4.8 pct June 2021

- sees wage price index 2.4 pct y/y Dec 2018, 2.5 pct Dec 2019, 2.6 pct Dec 2020, 2.6 pct June 2021

- labour market remains strong, leading indicators imply above average growth

- housing credit conditions tighter than have been for some time

- little evidence tighter credit was main cause of slowdown in home loans

- dwelling investment could fall off earlier and faster than previously projected

- outlook for business investment positive, see y/y growth 4.8 pct Dec 2019, 4.9 pct Dec 2020

- recent downturn in business surveys, if sustained, would imply weaker investment, employment

- global growth running at solid pace, growth in trade partners seen around trend

- China indicators suggest more pronounced slowing in momentum there

Headlines via Reuters

Full text is here:

Statement on Monetary Policy- February 2019

more to come