The focus is on the Federal Reserve's FOMC statement and Powell's press conference following

But, the Reserve Bank of New Zealand decision is due soon after the Fed

- Wednesday 21 March 2018 at 2000GMT

- Which is Thursday the 22nd local NZ time

I posted up a couple of previews last week:

- Reuters poll of 15 economists, all 15 forecast the RBNZ to hold rates

- ASB expect the RBNZ will leave the OCR unchanged at 1.75%

Another couple now:

ANZ:

RBNZ will leave the OCR at 1.75%, and retain a cautiously upbeat stance

- Grant Spencer's last OCR announcement as Acting Governor

- RBNZ will retain a clear, consistent message

Developments since the February MPS have been, on balance, more positive ... But this won't change the RBNZ's assessment a great deal

economy has weathered recent political uncertainty well

- business confidence off post-election lows

- near-term activity looking solid

- Overall, the economy is growing at about trend pace

- housing market stable

- terms of trade remain elevated

But at the same time, the NZD remains high, dampening activity and inflation

Headline inflation is set to remain low

- underlying inflation is expected to increase gradually

A broad spirit of cautiousness (particularly with regard to the inflation outlook) has underpinned the RBNZ's assessments for some time. And we expect that to continue for some time yet.

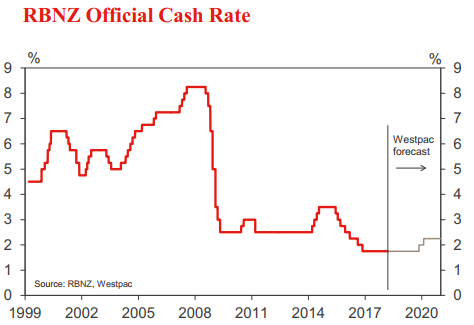

The RBNZ is not expecting to tighten monetary policy until the second half of 2019 and we agree with that assessment.

With interest rates on hold this year, OCR decisions have taken a bit of a backseat - you might even say they are being taken for granted. Fiscal policy and potential changes to the PTA and Reserve Bank governance are instead at the fore.

- Fiscal stimulus over the next couple of years will be large, particularly since it will put money in the pockets of people most likely to spend.

- Changes to the Reserve Bank's mandate are not expected to alter the conduct of monetary policy. But governance changes may have implications for how the Bank functions and forms its views. In that vein, there will be a keen interest in the next MPS - the first under the reigns of new Governor, Adrian Orr. We don't expect any major changes in the RBNZ's views, at least until he gets his feet well under his desk. But over time we will be looking to understand how the RBNZ operates under his watch. Will the RBNZ's views and policy strategy be the same under a new leader? Orr will we see something different?

Westpac:

- OCR review will surely be a low-key affair. There are times when the Reserve Bank has had to contend with a range of surprises that have had offsetting implications for inflation, leaving its assessment broadly unchanged. This is not one of those times.

- There is very little since the February Monetary Policy Statement that will have come as a surprise to the Reserve Bank. So its bottom line is likely to remain the same: "Monetary policy will remain accommodative for a considerable period".

(Westpac's assessment is little different to ANZ's, so I'll jump to this....)

OCR review will be the last one for Acting Governor Grant Spencer, whose term ends on 26 March.

- Perhaps more importantly, it's also the last one under the current Policy Targets Agreement (PTA) between the RBNZ Governor and the Minister of Finance. Of course there will still be a great deal of continuity beyond that, in terms of the RBNZ's assessment of the economy.

But with some impending tweaks to the RBNZ's targets, there's no scope for making any commitments about the future direction of monetary policy.

Incoming Governor Adrian Orr will need to sign a new PTA before he takes up the role on 27 March. No date has been given as to when we'll see the details of the new agreement. But it would be understandable if it was released after Thursday's OCR review, to avoid overshadowing the rate decision itself (and to avoid any confusion as to which agreement the RBNZ is currently operating to).

The Finance Minister has said that the new PTA will reflect his desire to include employment as part of the RBNZ's mandate. With that in mind, we could see some reference to "conducting monetary policy in a way that will best contribute to full employment", along the lines of the Reserve Bank of Australia's policy target. But this may only be a first draft of the employment mandate, ahead of the review of the Reserve Bank Act that is still under way.