The Federal Reserve's Federal Open Market Committee meet today, the announcement will come at 1800GMT

I posted a preview here already:

As you can, see expectations for anything of significance are low indeed

More now, this via Barclays (in brief and bolding is mine):

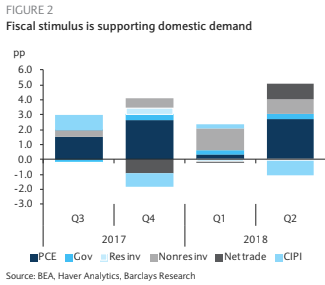

- We believe that the Fed is likely to read the Q2 GDP report as we do. We see participants as discounting the contribution from trade given the policy uncertainty and focusing their attention on final sales to domestic purchasers. On net, it is likely that the committee will conclude that stimulus is passing through to activity as anticipated.

- The August FOMC comes without a press conference or updated projections, leaving the FOMC statement as the only medium of communication. We think the main message will remain unchanged; in the face of sizeable stimulus, improving labor markets, and steadily firming inflation, further gradual rate hikes remain the most likely outcome.

- We expect two further 25bp rate increases this year, in September and December.

- The committee is also likely to debate further language changes to the statement, particularly regarding the assessment of the stance of policy and to what degree the committee wants to provide forward guidance about further gradual rate increase, but we see these changes as more likely to come closer to year-end.