I guess the headline above is the bottom line from the Federal Reserve expected on Wednesday

Barclays:

We expect a 25bp increase in the target range for the federal funds rate when the FOMC meets next week.

There have been important developments since the committee last submitted forecasts in December, namely, the implementation of the Tax Cuts and Jobs Act and the approval of the Bipartisan Budget Act.

- In light of the sizeable fiscal stimulus, the median committee member is likely to revise growth higher, particularly for 2019.

- In addition, we expect modestly stronger inflation and lower unemployment rate projections.

- We expect an unchanged median funds rate for 2018 and 20bp increases in the median funds rate in 2019 and 2020. We see the average funds rate rising 10-20bp across each of the three years.

The committee, in our view, is more likely to move to four hikes this year at the June meeting, when incoming data should confirm that fiscal stimulus is having the anticipated effects.

Morgan Stanley:

we expect the FOMC to:

- Raise the target range of the federal funds rate to 1.50-1.75%.

- Acknowledge fiscal stimulus while continuing to see "near-term" risks to the outlook as "roughly balanced".

- It will also continue to stress it is monitoring inflation data "closely", given the continued shortfall vs. goal.

Change the SEP to include

- faster growth with corresponding lower unemployment rate,

- but leave core inflation unchanged.

- We also look for the median assessment of longer-run unemployment to move lower.

- Show a pronounced upward drift, but leave the median number of hikes at 3 this year, raise the median path to 3 in 2019 and leave 2020 at 1. We think the longer-run neutral rate remains unchanged, though it is a close call.

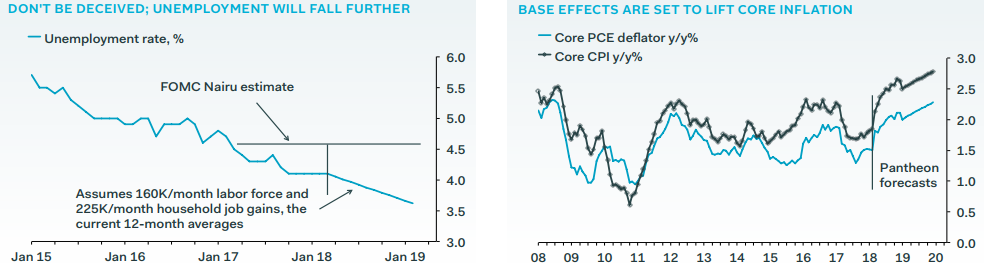

Pantheon Macro Economics:

- Today's hike likely won't come with a fourth dot for2018; no need yet to offer a hostage to fortune

- ....But stronger growth forecasts after the fiscal easing mean a third dot for 2019 is a decent bet.

More on the dots from Pantheon:

- Things could change as soon as the June meeting, though our base case remains that the fourth dot for this year is marginally more likely to appear in the September meeting. By then, the Fed will have much more data on inflation, wage growth and inflation expectations.

- For now, though, we're expecting something of a fudge for this year, with policymakers crossing their fingers behind their backs and hoping that this year really will see a clear increase in both productivity and labor participation.

- But for 2019, we expect to see a third dot today; that requires only two FOMC members to raise their forecasts by 25bp. Given the fiscal loosening, that seems a good bet.