ANZ's reasoning for projecting a higher end point for RBNZ rate hikes. To come in November.

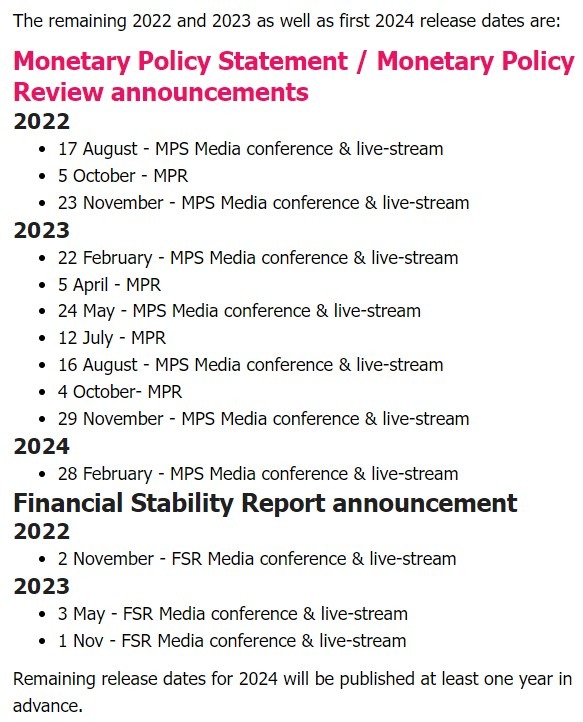

Consumer prices rose 1.7% q/q (7.3% y/y) — higher than our expectation of a 7.1% y/y lift, and the RBNZ's forecast for a 7.0% print. We have changed our OCR call and now expect the run of 50bp hikes to continue through to November, meaning an OCR endpoint of 4.0% rather than 3.5%. A 75bp hike at the August MPS is a very real possibility, particularly if the labour market data on 3 August delivers another hawkish surprise.

As expected, tradables (ie mostly imported) inflation rose to 8.7% y/y (8.5% previously), pushed higher by surging petrol prices in the wake of the war in Ukraine.

More concerning is the increased strength in non-tradables (ie mostly domestic) inflation, which increased to 6.3% —ahead of the RBNZ's forecast for a fall to 5.7% and our expectation of 6.0%. Domestically driven inflation tends to stick around a lot longer than the imported variety, and as such, the mix of inflation pressures revealed today demands a more aggressive RBNZ response.