- Prior was 4.25%

- Inflation is coming down in many countries, largely reflecting lower energy prices as well as improvements in global supply chains

- Inflation is projected to come down significantly this year

- If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases

- Governing Council is prepared to increase the policy rate further if needed to return inflation to the 2% target

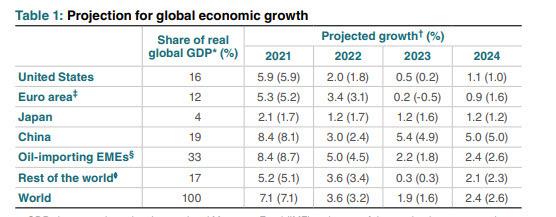

- The BOC estimates the global economy grew by about 3½% in 2022, and will slow to about 2% in 2023 and 2½% in 2024, which is slightly higher than in Oct

- In Canada, recent economic growth has been stronger than expected

- There is growing evidence that restrictive monetary policy is slowing activity, especially household spending

- BOC expects 1% growth in 2023, weighted towards the back half vs +0.9% prior. Sees 1.8% GDP growth in 2024 vs 2.0% prior

- Sees inflation this year at 3.6% vs 4.1% prior. Sees 2024 at 2.3% vs 2.2% prior

- The risk of a severe global downturn remains but appears to have lessened since October

- Full text of the MPR (pdf)

The Bank of Canada basically spelled it out, saying that they expect to hold rates from here. That was largely built into the market but there was considerable uncertainty as to whether they would explicitly signal it.

USD/CAD rose to 1.3411 from 1.3350. There's a broader market reaction as well with global bonds catching a bid (lower yields) as well. The US dollar is losing ground more broadly, likely on the idea that the Fed will ultimately follow the BOC.

Here are the BOC's projections for global growth.