While the market is focused on the balance sheet unwind and what that could mean (is it the natural maturation or does the Fed outright sell treasuries?), the Fed has announced their schedule of Fed purchases of treasuries over the next month.

The Fed taper is down to $40B per month and is supposed to be reduced by another $20B in February. If they continue that schedule, the taper will be down to $0 in March. The taper would be complete and the Fed can look to tighten.

Does it make sense for the Fed to continue to buy treasuries, when they are debating balance sheet reduction at the same time?

That seems to make little sense to me. Every Fed official is saying policy is accomodative, inflation is not transitory. We may need to tighten 4 times in 2022, but we will continue to buy bonds and mortgages at a $40B and then $20B clip.

Granted, it is small change vs what it was, and the balance sheet is near $9T so what's another $60B or so, but if you are looking to stop accommodation, stop the extra accommodation.

As a result one of the risks into the next meeting is if the Fed just says "we will not being buying any more treasuries after this tranche is complete".

Why not?

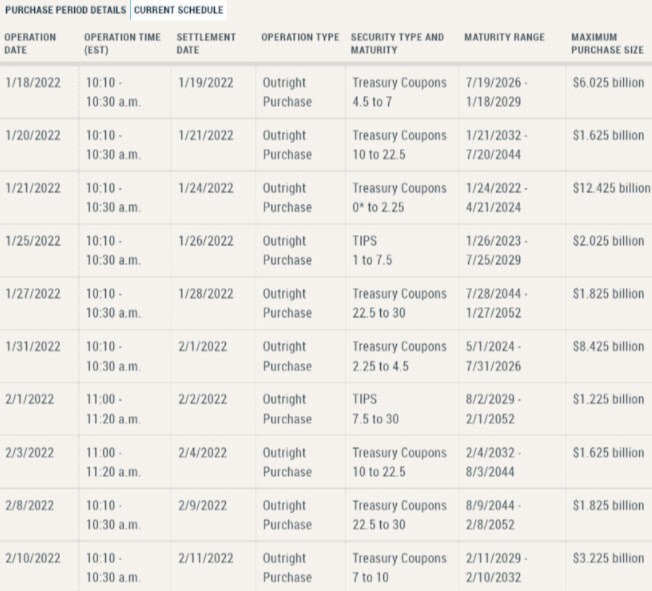

Below is the schedule and maturities of the proposed Fed buying starting on January 18 and ending on February 10.