Gold is suddenly shining brightly.

It has run into a tough tape for risk assets this week but the slide in the US dollar and monetary uncertainty have opened a window for outperformance. There's also a seasonal tailwind for gold that runs through February.

The catalyst for today's 1% rally is a report from the People's Bank of China that they added to gold reserves in November for the first time since 2019. Central banks tend to move slowly and deliberately, so this is likely a sign of what's to come.

They added 32 tons to its total of 1980 tons and it comes as market participants speculate that China, Russia and other countries not friendly with the USA will want convert dollar reserves to bouillon.

"Gold holdings in China as part of the total reserves are still very low, so there is probably room for further purchases down the road,” he said Giovanni Staunovo, an analyst at UBS Group AG.

China bought around $1650/oz compared to $1787 today.

What's still not clear is where the rest of the Q3 gold buying came from; the World Gold Council reported that central banks had bought 400 tons of gold.

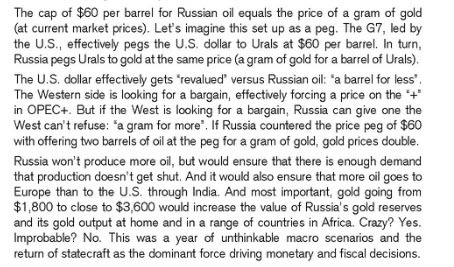

In other gold-bullish news this week, Credit Suisse analyst Zoltan Pozsar went on a bit of a tangent in a note and suggested Russia could start selling oil for gold.

Finally, the implosion in the crypto space is bullish for gold. There's a segment of the investing public that's always looking for monetary alternatives and all the difficulties stemming from FTX makes old-fashioned gold look fashionable again.