How to trade TRY

The Turkish Lira has fallen dramatically in recent weeks. The Lira is down over 30% on the year and it had a 16% drop on just the 10th of August alone. One of the key reasons for the implosion of the economy has been Turkey's current account deficit.

This simply means that Turkey's economy is operating on borrowed money, with other countries financing the economy and allowing the country to run on a deficit. Turkey has an external financing need of over $200bln. According to the Financial Times there will need to be repayments of over $130bln this year.

Take your trading to the next level today

On top of this current account deficit a strong USD with the Federal reserve on a path of rate hikes has added pressure to the USD/TRY pair. Furthermore, Erdogan placed his own son in law in charge of the central bank. This move has resulted in some strange economic decisions with one of the most marked one being a strong reluctance to raise interest rates, even though the country has desperately needed to in order to address its rising inflation.

So, if you want to try and capitalize on the Lira's recent volatility here are 5 tips for trading the USD/TRY.

#1 Check the spread

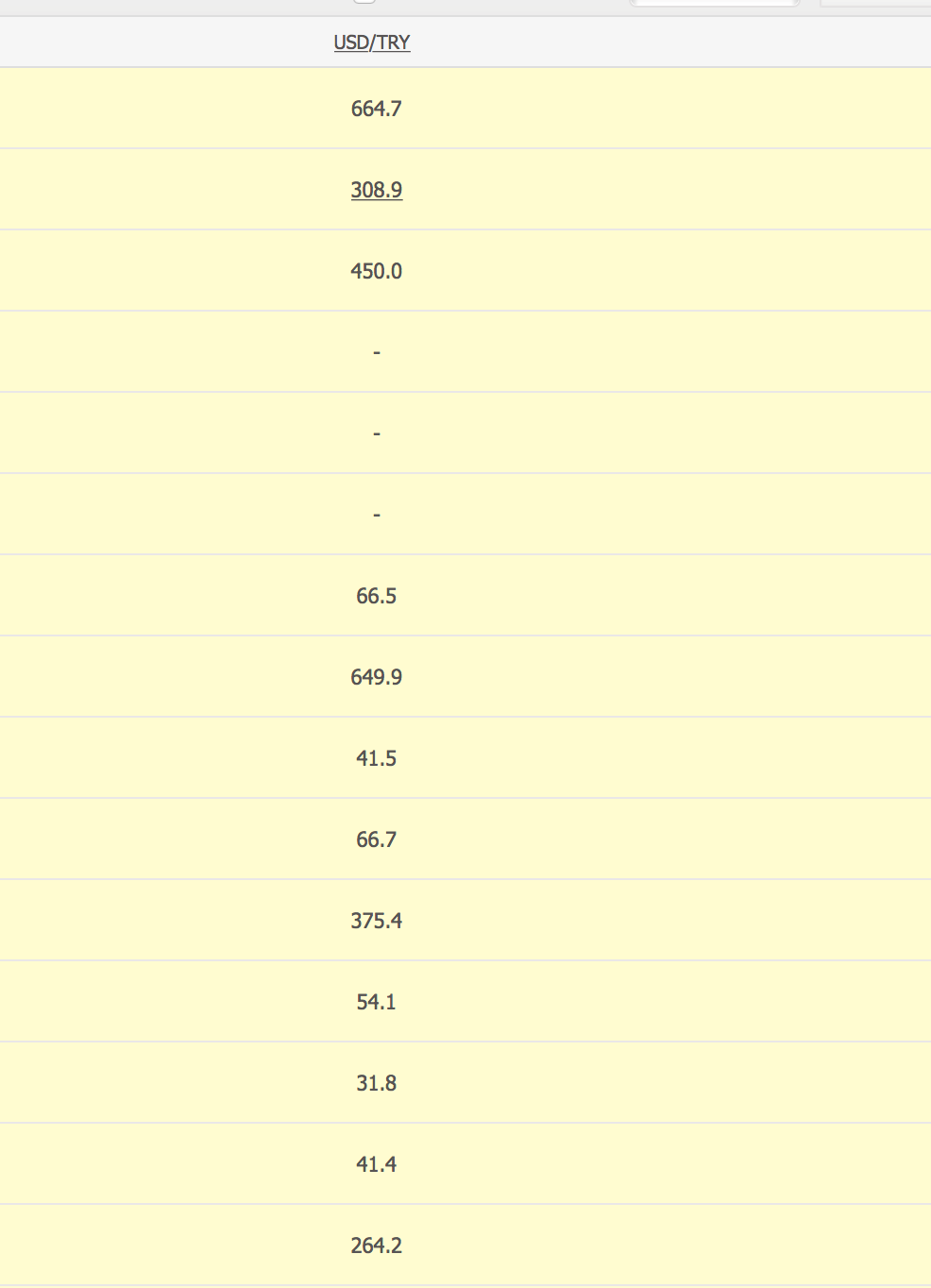

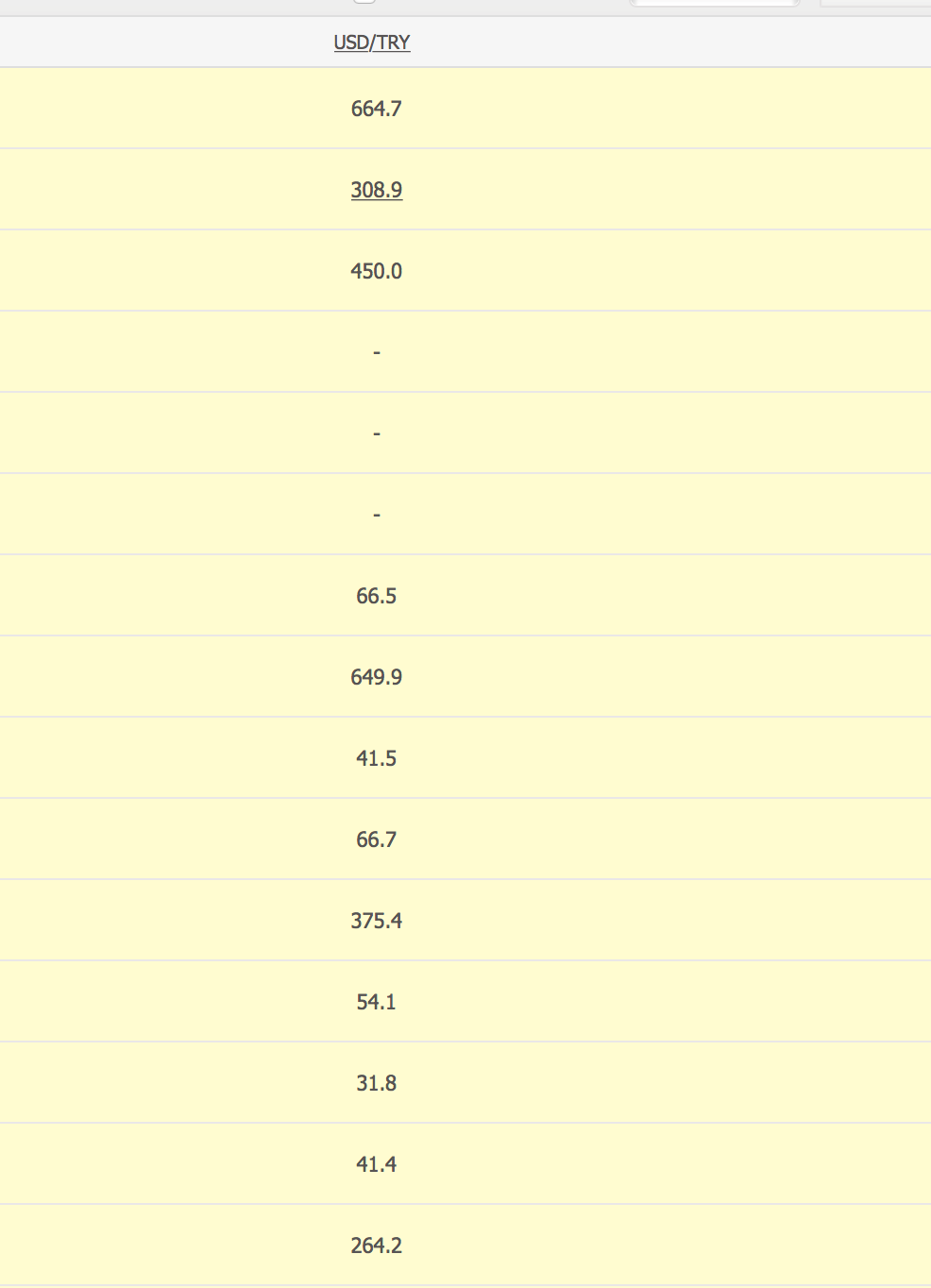

The first tip before you open a trade on the USD/TRY pair is to check the current spread. The spread for the USD/TRY pair can be large, and in the snapshot below taken from a number of different brokers the spread varied from 660+ points to 31.8 points at a moment in time. So, before you place your trade, just check the spread so that you don't enter during an illiquid time and pay a hefty premium for doing so. This is particularly relevant if there is a strong time of uncertainty or volatility in the market. It is at these times that spreads can widen considerably.

#2 Check your position size

Due to the large number of points on the USD/TRY pair it can be very easy to open a very large position size by accident. So, as a general rule of thumb, you will need to use 1/10th of your normal lot size. If for example, on an intraday EUR/USD trade, you normally trade with 1 lot, then to do a similar amount of your normal risk trade on the USD/TRY pair you would open only 0.10 lots.

So, do not open a USD/TRY position size without first calculating your risk. With a large spread, and a lot of points on the pair it would be very easy to open too large a position and you could find yourself with a margin call in no time at all. So, make sure you check that position size. If you open a position casually you will quickly regret it.

#3 Using moving average to define and limit risk.

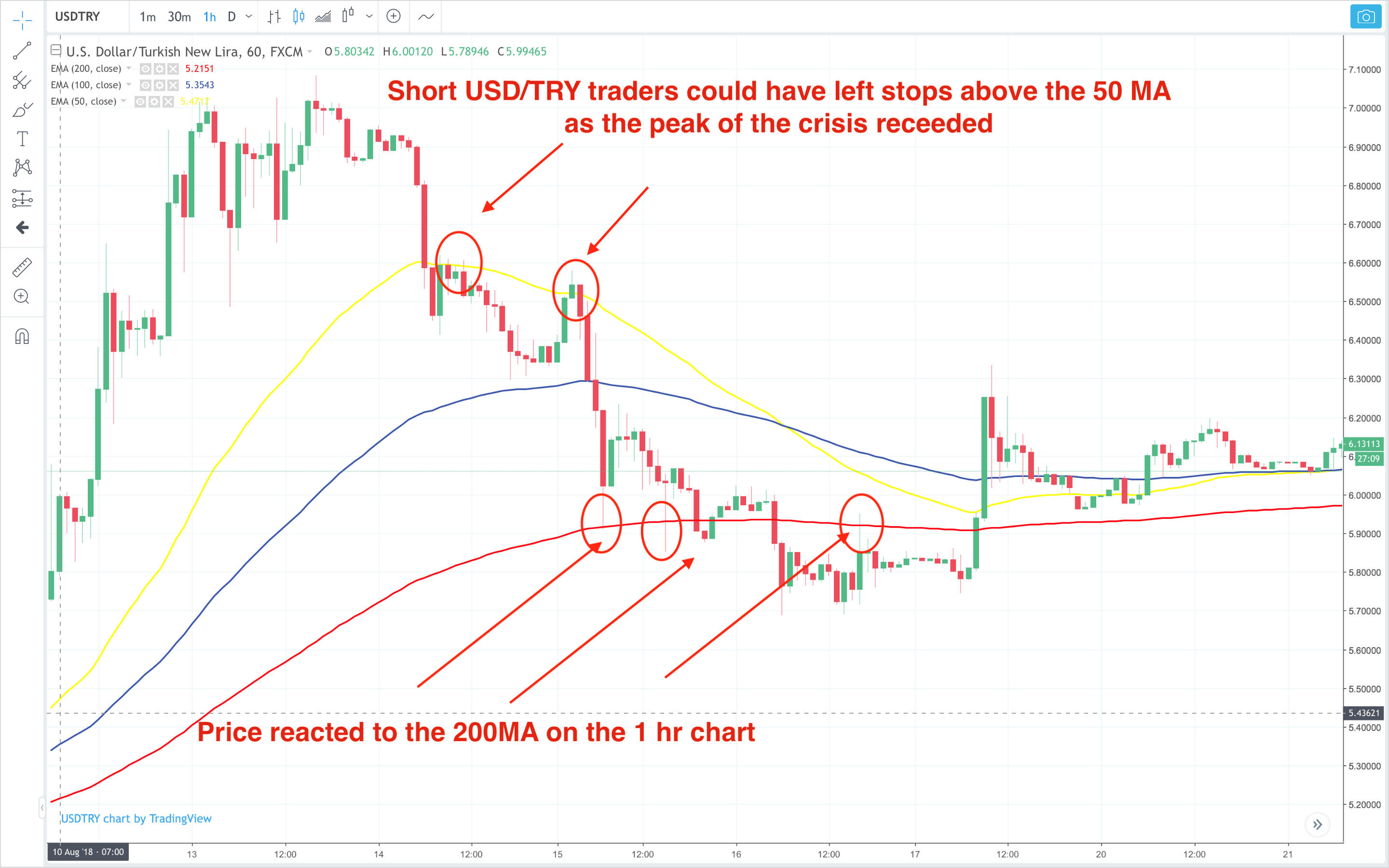

You can use the 100 and 200 moving averages to define and limit your risk. With the large moves we have had recently the 50, 100 and 200 moving averages have provided places for traders to lean against.

You can define and limit your risk with the ebb and flow of news out of Turkey. Going forward these moving average levels will be excellent levels on the 1hr, 4hr, and daily charts to find good places to enter and sensible places to put your stop.

#4 - Keep an eye on the EUR/USD pair

A far more liquid pair to trade than the USD/TRY is the EUR/USD. The EUR/USD pair is being affected by the Turkish Lira crisis due to the amount of financing that Europe's banks have given to Turkey.

The fear was that if the Lira became any weaker than the Turkish banks and institutions would default on their loans they had taken from Europe's banks. As a result, the Euro lost value with the Lira. So, a smart move, if the Turkish crisis re-emerges, and the Lira weakens again, might be to short EUR/USD.

The pair has a much higher liquidity that USD/TRY, being one of the world's most traded currency pair, and a much smaller spread. Risk is also easier to calculate on the EUR/USD pair than on the USD/TRY pair, so this is worth remembering.

#5 Keep an eye on the news

Turkey introduced a number of measures which have temporarily halted the tumble in the Lira. However, the next direction will be decided by the actions of the US and Turkey. Any improvement in politics between the US and Turkey will be supportive. Recently Qatar injected $15bln of support which helped further stem the bleed of the weakening Lira.

The key event to look out for though, is a central bank rate hike to start addressing the twin problems of a weaker Lira and higher inflation which is affecting the country. This will cause the Lira to strengthen and is what markets are really wanting to see happen in order to give strength to the failing Lira.

This post was submitted by LegacyFX