Why it's valuable, but not in a vacuum

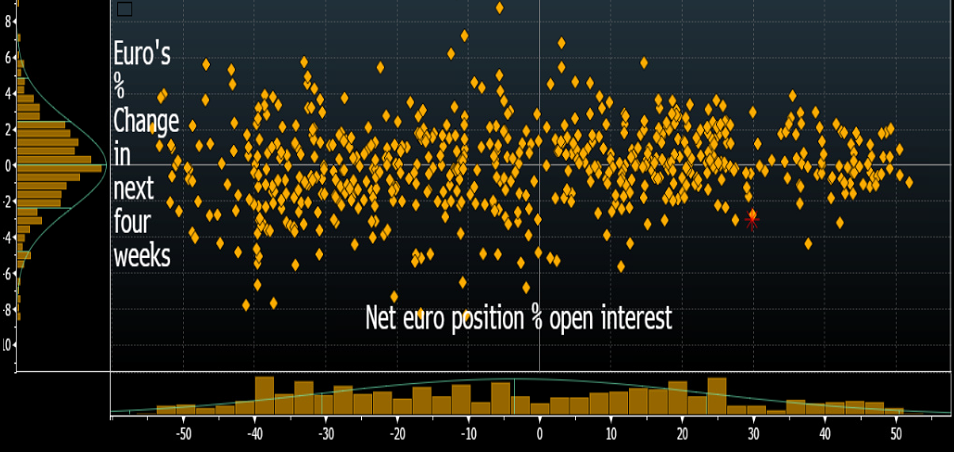

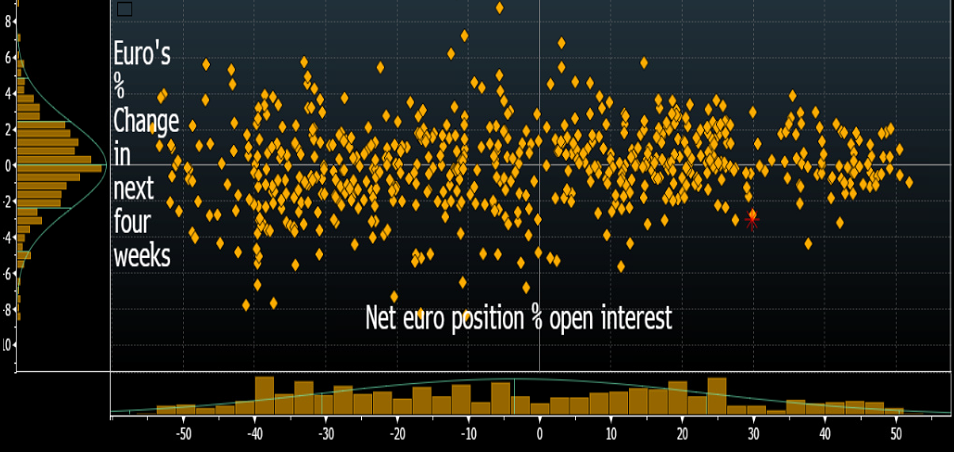

Bloomberg has a bit of a takedown on CFTC positioning data as a contrarian signal of FX moves. They only look at EUR/USD trade, which is a narrow scope and looks at the net euro position as a percentage of open interest compared to moves over the next four weeks (which is also a narrow timeline).

It looks essentially random.

Here's what they're missing: Nothing happens in a vacuum.

Since April 17, when euro net longs hit a record, the euro is down 3.4%. It was a fantastic contrarian signal in that report.

Why? Because it wasn't just about the net position. As I wrote at the time "This euro position looks crazy. The data has been poor lately."

If you looked at the huge net long and combined it with a run of incredibly poor data, it was no surprise that in the following week, the ECB started to talk about slower growth and the euro started to dive.

Another thing to note is the timing of the change in positioning. For the euro, for instance, much of the rise in speculative longs came in mid-2017 when the euro was trading around 1.12. So a fall from 1.24 to 1.19 isn't the end of the world for the bulls who are deep in the money.

The rise in NZD net longs recently is a good example of positioning being underwater. It was something I highlighted a few weeks ago as the kiwi began to drop.

An even better example is the Canadian dollar at this time last year (a currency that's notorious for burning specs). Longs piled into USD/CAD (short CAD) in April and May as the pair rose to 1.37 from 1.35 and the net short hit a record in late May but by that time, the move had already started to fade -- the entire position was underwater.

The orange line is the FX move and specs got way out of ahead of it and then were quickly underwater and that resulted in a massive move in the other direction, especially once Wilkins signaled more-hawkish policy.

So the CFTC data -- like all technical indicators -- won't work in a vacuum. They're not a black box, but if you combine them with other information and common sense, they can give you an edge.